Today’s federal commitment to create a national dental care program will help millions of Canadians, but there’s a huge missed opportunity to move forward on pharmacare, long-term care and needed health care spending to deal with the pandemic’s impact.

Overall, there’s room to go much bolder than this budget does. Many Canadians are feeling the weight of living in uncertain times. They need better income security, better access to Employment Insurance if they lose their job, more affordable housing, and the world needs a bolder climate change plan than what’s on the table. [See more of our experts’ analysis below]

While we welcome the new federal excess corporate profits tax, we can go further. Canada’s big banks have been raking in excess corporate profits during the pandemic, but there’s room to cast a wider tax net. Banks and insurance companies aren’t the only companies making over $1 billion a year. Those industries only amount to one-fifth of public companies in Canada turning that level of profit. The other 80 per cent of companies in that club—in oil and gas, tech and groceries—declared net income of $107 billion last year and they won’t see any new excess profit taxes. The missed opportunity in this budget means there’s no need for panic at the country club.

– David Macdonald, CCPA Senior Economist

We can go bolder on housing

After deserting the housing file for more than 20 years, the federal government began to take steps to address the housing crisis over the past five years. In 2022, with everything that is going on in Canada and internationally, housing is a top budget priority. The federal government is clearly back in the housing game—and that’s good news—but there’s room to go much bolder and do more for tenants.

The budget extends the Rapid Housing Initiative (RHI), which provides not-for-profit providers funding to acquire and build non-market housing. This program is a latecomer to the National Housing Strategy (NHS) but arguably the most effective initiative therein. The one-year extension is welcome but it’s time to make this program permanent.

The second supply-focused initiative is called the Housing Accelerator Fund. The idea here is to provide financial incentives for municipalities that speed up housing developments. We can’t be sure that municipalities will bite. And if housing is built, chances are they will not be affordable for most people. The jury is still out on this new initiative.

The third announcement on the supply side is new support for co-operative housing—probably the best news in the housing budget. Shifting funding and capacity to non-market housing is the best and most direct way to ensure housing affordability, now and in the future.

The ban on non-resident buyers is getting a lot of airtime. This is a good measure to put in place—but let’s not expect housing prices to come crashing down as a consequence. They won’t. Non-residents own a small share of the housing stock. The government is also putting forward a measure to penalize flipping of the housing market. It may also not have much of, or a direct impact on, prices, but it is good to see governments finally making use of regulatory powers. A lot more can be accomplished that way—and it’s free.

Families living with low incomes who are in receipt of the Canada Housing Benefit will get a $500 one-time top-up. This is part of the NDP-Liberal agreement. Targeted direct transfers to low-income households during high inflation is positive and effective. But people pay rent every month, and rents never go down, only up. This should’ve been a permanent change.

On the downside, most tenants get nothing. In my estimate, two-thirds of tenant families do not qualify for housing supports and don’t earn enough to aspire to own. What they need most is for out-of-control rents to be reined in.

Finally, this is yet another budget without strong and decisive measures to curb the financialization of housing. By this time next year, even more homes will be owned by speculators rather than by working families.

– Ricardo Tranjan, CCPA Ontario Senior Researcher

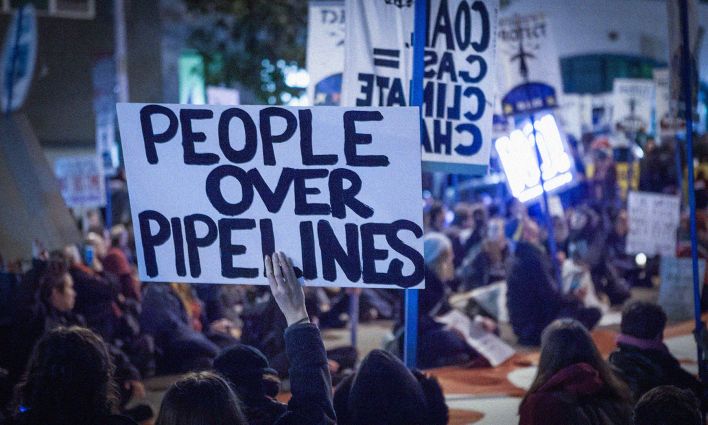

We can go bolder on climate change

The budget delivers on the $9.1 billion in spending announced in the government’s recent Emissions Reduction Plan. Much of that money will support Canada’s adoption of zero-emission vehicles (ZEVs), including through the extension of consumer ZEV purchase incentives, nearly a billion dollars to build out electric vehicle charging stations, and a new federal mandate for ZEV sales.

Electric cars are one piece of the climate puzzle, but we need to go bolder if we’re going to reach net-zero emissions by 2050. Ironically, the single biggest new “climate” measure in this budget is a $2.6 billion tax credit for carbon capture, utilization and storage. This money will help heavy industry—including an oil and gas sector that declared $34 billion in profits in 2021—to continue using and producing fossil fuels instead of being forced to phase them out. The CCUS incentive is yet another fossil subsidy at exactly the time when our efforts should be focused on actively winding down oil and gas production.

As yesterday’s decision to greenlight a new offshore oil rig illustrates, the federal government wants it both ways on energy: to use less fossil fuels at home while producing ever more fossil fuels for international markets. Climate policies that don’t curtail fossil fuels at the source are not compatible with a climate-safe future.

Though the budget makes scant mention of a just transition, there are commitments to worker consultations and retraining in general. The government also sets aside $3.8 billion for a critical minerals strategy that will help scale up a number of key industries for the clean economy. Critical minerals present an opportunity for economic diversification for many of the workers and communities that currently depend on fossil fuels, but to maximize the benefits the government must deliver on its long-promised just transition legislation.

– Hadrian Mertins-Kirkwood, CCPA Senior Researcher

We can go bolder on income security

Low-income communities are still waiting for promised Employment Insurance reforms and the Canada Disability Benefit. This budget expands access to EI training via improved Labour Market Transfer Agreements but major changes like coverage for the self-employed, higher benefit levels, and secured federal funding are completely missing this year. As major pandemic programming is winding down, low-income communities have been left hanging.

– Katherine Scott, CCPA Senior Researcher

We can go bolder on the care economy

Dental care in this budget and child care in last years’ are hugely important programs to launch nationally but there remain significant gaps. The new child care infrastructure fund should help build out the many new spaces that will be needed as fees fall. Dental care, starting with children, will likely make a huge impact on the largest reason why children are admitted to hospital: caries.

In other areas though, this budget makes no new progress. Pharmacare is perpetually five years away. Long-term care, which garnered federal support in the emergency, doesn’t merit a mention this year. What happened to the promised Safe Long-Term Care Act? Where are the promised national standards?

Last year, the government announced its plan to create a National Action Plan against gender-based violence—with an initial investment of $600 million over five years. Additional monies ($539 million) have been pledged this year to support provincial and territorial programming, all to the good. We can hope that these new funds encourage cooperation and that the National Action Plan will be released shortly. And the implementation of the Calls to Justice of the Missing and Murdered Indigenous Women and Girls Inquiry demands action. Victims and their families have waited long enough.

One more thought: we will never make headway on improving Canada’s care economy if we don’t stop the exploitation of care workers. Wages are not keeping up with inflation, even as job vacancies skyrocket. Expanding foreign temporary workers programs will further compound the problem. This budget missed an opportunity to improve wages and standards for all care workers.

– Katherine Scott, CCPA Senior Researcher

We can go bolder on equality

There are several important measures in this budget that respond to community demands, including $100 million over five years to support the implementation of the forthcoming Federal LGBTQ2 Action Plan and $85 million over four years to launch a new Anti-Racism Strategy and National Action Plan on Combatting Hate.

Additional funding ($273 million) has been allocated to the Opportunities Fund to deliver an employment strategy for persons with disabilities and $1.9 million is being provided to wrap up the Employment Equity Act Review by this fall—essential work that will lay the foundation for a more inclusive labour force.

But you get the sense that equality wasn’t top of mind in this budget. Last year, the word “gender” was mentioned over 750 times. This year the number is 18. Gender equality advocates were under no illusion that there would be a fight to realize the potential of Budget 2021. With the resounding silence of Budget 2022, that fight clearly continues.

– Katherine Scott, CCPA Senior Researcher

No need to go bolder on military spending

Let’s look at the big boost of $8-billion to National Defence more closely: notably, a 7:1 ratio of defence spending to spending promised for international development.

To be sure, the Russian invasion of Ukraine has dramatically shaken the public’s sense of security and strengthened the defence lobby’s hand. Billions of defence dollars will be spent to buy a fleet of 88 controversial F-35 stealth fighters—more than the almost two dozen plans the Conservative government said it would buy in 2010, and the Liberals opposed at the time. Here’s another contradiction: this budget’s military spending boost is intended to address what is generally seen as Canada’s low level of military spending within the NATO military alliance when, in reality, Canada is near the top. NATO’s own figures compare members’ spending in actual dollars: Canada is sixth highest in the alliance behind the U.S., U.K., France, Germany and Italy.

– Steven Staples, CCPA research associate and CCPA Members’ Council member

We can afford to go bolder

There are few details of the government’s Strategic Policy Review, which plans to cut $3 billion a year from government expenditures by the fifth year. The details aren’t going to be clear until the fall update, but could program cuts be in the works? That would be unnecessary.

Federal debt is certainly higher due to COVID-19 mitigation, but it’s important to remember that interest costs are way down. Despite new debt incurred to keep the economy afloat during COVID-19, interest payments-to-GDP are lower now than at any time in the past century. In fact, interest costs actually fell since the fall 2021 fiscal update, saving the federal government an additional $1 billion in 2022-23 and $1.6 billion in 2023-24. Rates started to rise between the fall update and this budget, but what the federal government pays to carry that debt has decreased.

Here’s the silver lining: economic growth is yielding higher federal revenues (up $15 billion in 2022-23 since the fall 2021 update), so investments made today will continue to be affordable tomorrow.

– David Macdonald, CCPA Senior Economist