When MPs head back to the Hill next week, we can expect an already heated debate about tax fairness to go up a few more degrees. At the heart of the matter is a decade-old tax loophole accessible to very few people and with very few spinoff benefits to the economy as a whole. But the debate also raises important questions about who we consider members of the middle class, and how serious we are about addressing income inequality in this country.

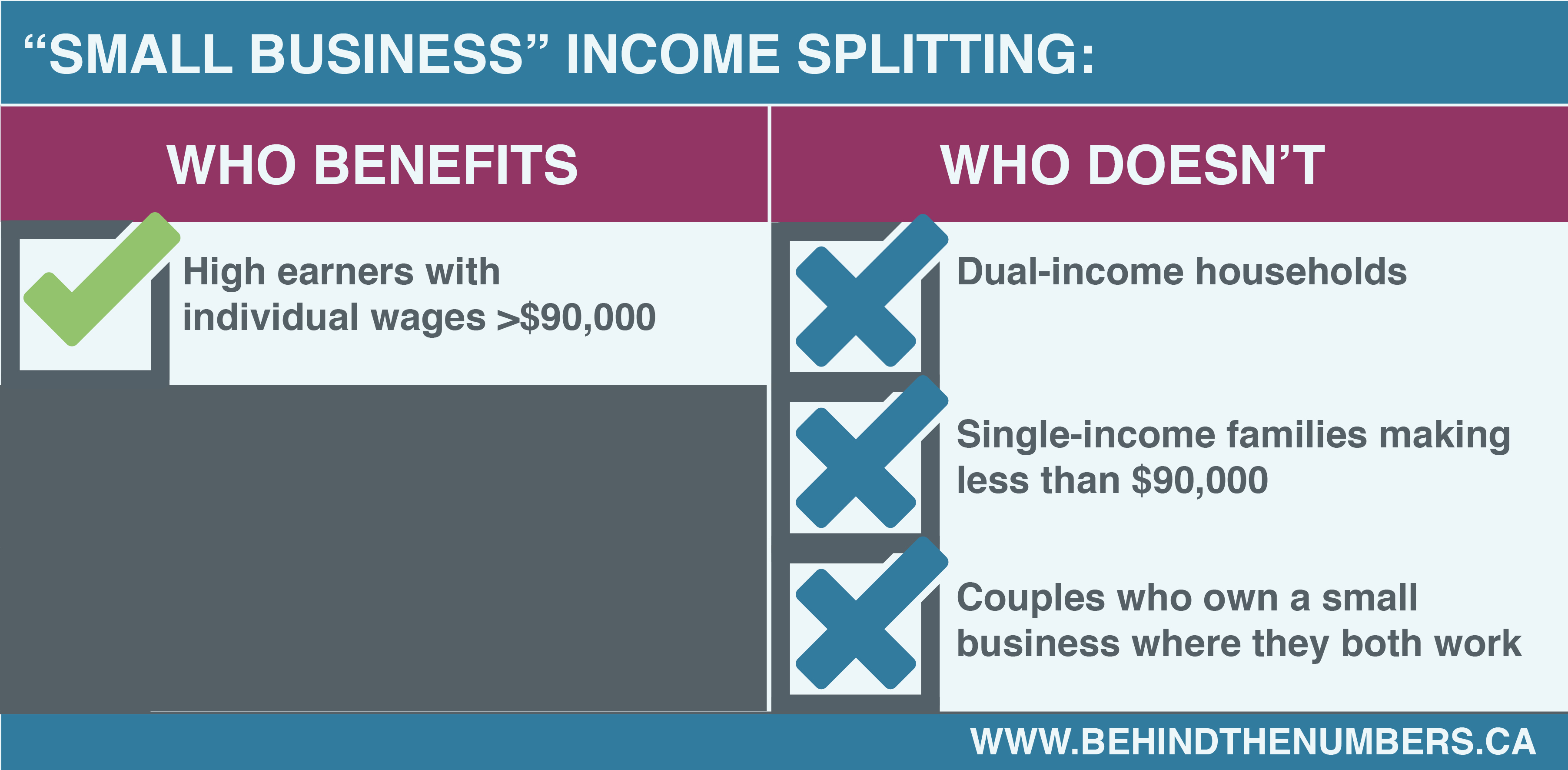

Who are the income splitters? For most of September, political parties, business associations, farmers, doctors, and the tech sector have been arguing over the federal government’s plan to remove a tax exemption designed to allow small businesses to assign the income of one earner to other members of their family. The exemption is being used by high-earning professionals, who make more than $90,000 a year. Currently, these high-earners can incorporate as a small business by setting up a Canadian-controlled private corporation (CCPC). This allows those professionals to assign a share of their income to family members, which frequently pushes them into a lower tax bracket. The federal government is proposing to close this loophole and stop allowing this kind of income splitting (or “sprinkling”).

Professional associations, including the Canadian Medical Association, have raised multiple objections to this proposal. They argue that income splitting predominantly benefits middle class families and leaves more capital available to finance new business ventures. These groups also claim that since family members are implicated in the financial risk taken on by the incorporating individual, it is only right they should receive income from that corporation. Let’s examine these claims.

Risk and reward Starting a business can indeed be risky and government supports for small businesses make sense. However, there is nothing inherently risky about incorporating as a CCPC. Too many high-income earners are doing it to lower their tax burden, not to create new enterprises.

For those who do start small businesses, from which they and the economy will hopefully benefit, is income splitting really the best way to help mitigate risk? Income splitting provides the greatest reward (tax break) to the enterprise with the greatest profits, and the least benefit to small businesses who are working hard to break into new markets and break even.

This is an upside-down approach to risk mitigation with little spinoff benefit to the economy. It would be better to build on government financing programs for small- and medium-sized enterprises by targeting support where private equity is lacking.

Not a tool for gender equality Opponents of the proposed changes have attempted to portray income splitting as a tool for gender equality. This argument suggests that female professionals who incorporate can then split their income by assigning a portion of that income to their (presumed to be) male spouse. The male spouse, in turn, takes on a fuller share of unpaid child care work, freeing up the female professional to work irregular and long hours.

While an interesting example of inverted gender roles, in reality only 7% of families are made up of a sole female earner and one spouse who stays home (i.e., 93% of the time a sole male earner or both spouses have paid employment). In fact, every high-income country that has ever implemented a form of income splitting has seen the same result: lower female labour force participation.

Income splitting provides an incentive to keep the lower-income earner in low income, or no income. Because women (even female physicians) earn less than their male peers on average, perform more unpaid child care work than do men, and the cost of paid child care is so high, all of the incentives in income splitting point toward keeping women out of the labour market.

Solutions for everyone Policies like providing universal and accessible child care—which has a demonstrable impact on women’s rates of employment, promotion and pay—would have a far greater capacity to support professional women. Paternity leave, along the model offered by the Quebec Parental Insurance Program, has also been shown to shift the burden of unpaid child care work—with three out of four new fathers in Quebec now taking over a month of leave after the birth of their first child. These are reforms that would really work for working women.

Tax reform is complicated. This is one small piece. But a more progressive (reformed) set of tax policies could deliver the revenue needed to improve health care, support the unemployed, provide childcare and even pay for new programs like pharmacare. It could do it in ways that cost less and benefit everyone, not just the top 10%.

David Macdonald is a senior economist and Kate McInturff is a senior researcher with the Canadian Centre for Policy Alternatives.