I was asked on Tuesday to present to the federal Finance Committee and comment on the government's latest budget. I thought I'd share my remarks with readers:

I’d like to thank the committee for their invitation on this important and ongoing issue of “fiscal sustainability and economic growth” in Canada. It is unfortunate that 5 years after the recession we are still talking about economic growth and the lack of a full recovery in either GDP growth or the labour market.

Anaemic growth is exacerbated by government austerity at both the federal and provincial levels. While government spending was a significant driver of economic growth in the year after the recession, that influence has now waned. The federal and provincial government cutbacks inevitably mean slower growth and less employment both within the public service and in the private sector companies that contract with governments.

Many of the other drivers of economic growth have also been muted. The balance of trade since 2009 has turned negative meaning we import more than we export and trade becomes a drag, not a driver on GDP growth in Canada. Increased resource exports have not made up for the collapse of the manufacturing sector. Every year we are now exporting our national wealth and no longer using international trade to our advantage. Instead, other countries are using us to their advantage.

Business investment over the past year has added little to economic growth. Instead, Corporate Canada’s bank accounts continue to growth with ever higher levels of cash holding that accumulate in good times and in bad.

Economic growth over the past year has come almost entirely from consumers through household consumption, although interestingly not from housing construction as has been the case previously. Given stagnant wages for most households, the increase in the past year in consumer spending has come almost entirely from an increase in household debt. This increase in comes as households already have historically high levels of debt.

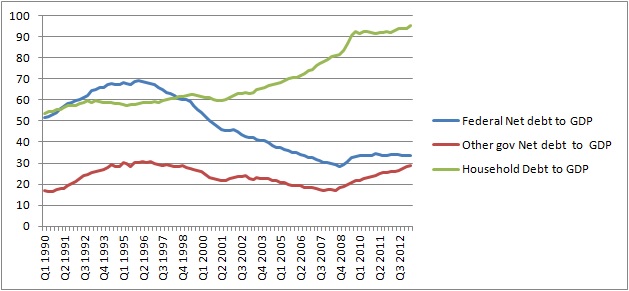

Fiscal sustainability at the federal level is often taken in isolation from the rest of the economy. For instance, federal fiscal sustainability is presently defined as reducing the federal government’s debt-to-GDP ratio from 33% to 25%. Even at 33% Canada’s federal government has the lowest debt-to-GDP ratio of any federal government in the G7. There is no pressing economic need to further widen that gap. Moreover, there are much more pressing sustainability issues in the Canadian economy outside of the federal government’s relatively small and manageable debt.

As I mentioned earlier, households have been doing the heavy lifting in terms of economic growth since the recession. The federal government is overly concerned with its small 33% debt-to-GDP ratio, while households now have a record debt-to-GDP ratio of 95% up dramatically from the 50% levels they were at in 1990s. If any sector in the Canadian economy is overleveraged with debt it is surely the household sector, and not the federal or provincial governments.

Household incomes have been constrained, among other things, by a labour market that has still not seen a full recovery either in the unemployment rate or, and perhaps more importantly, in the employment rate or the % of working age people with a job. While there has been a decline in the unemployment rate, part of this is due to discouraged workers simply giving up looking for a job. Excluding this effect by using the employment rate, there has been much less recovery in the percentage of working age people with a job in Canada.

Moreover, those that have jobs don’t see the sort of regular real wage increases that they saw in previous decades. In Canada’s largest cities of Montreal, Toronto and Vancouver, the average real income of the bottom 90% is lower today than it was in the 1980s. For lower income Canadians, programs like the Temporary Foreign Workers program likely further suppress wages. In fact of all the jobs created since the worst of the recession, about 10% were for Temporary Foreign Workers.

Stagnant incomes mean that increased consumer spending comes from debt accumulation and not from rising incomes.

This should be the target of federal government policy. Real wage increases in the middle, better support for low-income Canadians and more job creation particularly for youth should be the federal government’s goals. These broad strokes will hopefully result in an orderly deleveraging of households, by and large the largest sustainability threat that Canada currently faces.