Another week, another skewed economic assessment of Ontario’s move to a $15 per hour minimum wage.

This time, it's TD Bank making dire predictions about job loss. But modern minimum wage research says something very different, suggesting that TD’s claims are overblown.

Their gloomy prognosis discounts the findings of much recent research, which points in the opposite direction: negligible job losses and substantial net benefit for low-wage workers.

On a positive note, TD's economists are more careful than CANCEA, the authors of the analysis promoted by the Ontario Chamber of Commerce a few weeks ago. CANCEA’s analysis made the outrageous claim that increasing the minimum wage (along with the rest of the improvements to employment standards proposed in Bill 148) would result in both massive job loss and massive price increases — something unheard of in the literature.

CANCEA's analysis was roundly criticized by Canadian economists from across the political spectrum on Twitter and critiqued in detail by Zohra Jamasi and myself in an earlier post.

TD's briefing note is at least explicit about impacts of minimum wage increases on both sides of the cost-benefit ledger.

The discussion of effects on business investment is robust: the note correctly states that a higher minimum wage can lead to lower turnover and more productive, better-trained workers.

Yet other parts of their discussion of big picture effects still rely on outdated stereotypes. For example, TD's analysis of the increase in consumer spending quickly reverts to the idea of the minimum-wage worker as a middle-class teenager, while we know that the majority of workers making less than $15 (and not just minimum wage) is not reflected by this stereotype. Roughly 80% of Ontario workers making under $15 per hour are over the age of 20.

This stereotype of the minimum-wage teenager — which similarly appears in CANCEA’s take on the minimum wage — is central to the biggest problem with TD's analysis: predictions of large job losses that are out of line with the latest research.

It looks like TD's economists make the common mistake of misapplying the potentially higher job losses for teenagers to the entire workforce, choosing to ignore the emerging consensus around negligible to small job impacts.

In the jargon of economics, this is an argument about elasticities of employment to the minimum wage. “Elasticity” in this case is a technical term for expressing the percentage change in employment when there is a 10% increase in the minimum wage. So an elasticity of -0.05 means that a 10% increase in the minimum wage generates a 0.5% reduction in employment.

TD economists assume that the elasticity of employment is -0.1 to -0.3 (a 10% increase in the minimum wage leads to a 1-3% reduction in employment). These numbers reflect a view that is (a) outdated and has been overturned since the 1990s when new, more sophisticated economic methods became available and (b) applies, if at all, only to teenagers. Much of today’s best research consistently shows elasticities statistically indistinguishable from zero for adult workers. This translates into, on average, little to no job loss overall resulting from moderate minimum wage increases. Some studies have even shown small job gains as a result of minimum wage increases.

The authors of the TD briefing note try to paint a picture of conflicting studies, but it is really the weight of evidence from multiple studies, primarily from the United States, where minimum wage research is most active, that has solidified this new consensus. The evidence includes “studies of studies” that synthesize multiple individual studies.

The major Canadian study in this new vein of research was published by David Green and Pierre Brochu in 2013. It produced similar results to those from U.S. researchers, save for a still relatively high elasticity of -0.25 for teenagers.

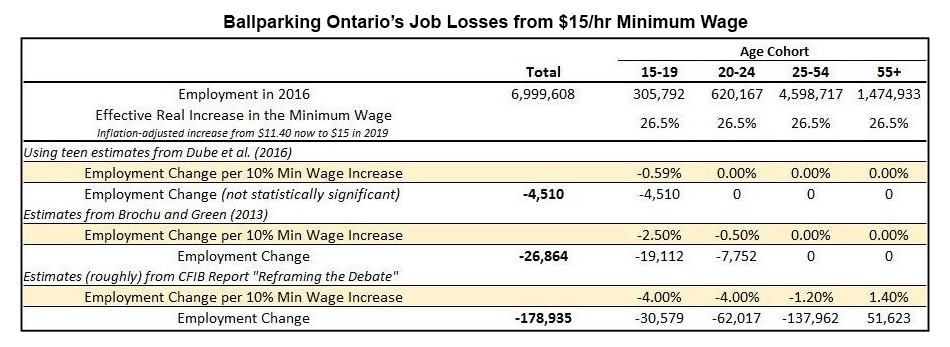

A helpful table posted on Twitter by Trevor Tombe from the University of Calgary shows that using numbers from the most recent Canadian and U.S. research would produce job loss estimates between two and 10 times smaller than the low end of TD's estimates.

Source: Twitter

In fact, the high end number of 150,000 jobs provided by TD is close to discredited reports like that from the Canadian Federation of Independent Business (included by Tombe for comparison in his chart).

The dire prediction of job loss offered by TD reflects a view from bygone days, one that has undergone a tectonic shift as a result of a more nuanced understanding of how the labour market works, and more sophisticated statistical techniques.

A recent op-ed co-authored by two past presidents of the Canadian Economics Association, Jim Stanford, and myself reiterates this point:

‘High-wage’ and ‘low-wage’ firms can co-exist in the same sector, since high-wage employers benefit from lower recruitment costs, reduced turnover and perhaps more motivated employees. In this environment, economic theory implies that moderately higher minimum wages can increase or decrease employment (emphasis added).

In today's new consensus, Nobel Prize winner Paul Krugman cites Mr. Card and Mr. Krueger with starting an "intellectual revolution" in economics. Seven other Nobel Prize winners endorse a 40% increase in the U.S. minimum wage, and a former editor of The Economist, the world's most influential free-market voice, recently called for big minimum-wage hikes to help boost lacklustre purchasing power across the industrialized world.

If the costs of raising the minimum wage to $15 are overblown by TD, then the benefits are minimized in proportion. Take just one example: TD says that raising the minimum wage has no major impact on poverty. At one point, the TD note even claims that lowering the minimum wage reduces poverty!

Again, TD's economists have not been paying attention to the new wave of minimum wage research. A very recent paper by Arin Dube, one of the foremost U.S. minimum wage researchers, clearly shows raising the minimum wage leads to significant poverty reduction: a 2-5% decrease in the number of non-seniors living in poverty for every 10% increase in the minimum wage, as well as increases in household incomes for the bottom half of households, with the largest gains among households in the bottom quarter.

And, once again, this is not just one paper. Dube takes 12 of the most credible recent papers on the topic, even including two from the best-known academic opponent of raising the minimum wage, David Neumark, and shows that nearly all of them report consistent, sizeable poverty reduction stemming from increasing the minimum wage. (For a good, non-technical explanation of this research see this piece in the Washington Post.)

It is telling that TD's report quantifies only its chosen negative effects of minimum wage hikes like job loss while leaving out many quantifiable positive effects like poverty reduction. Not once do we hear how many billions of dollars in extra wages will go into the pockets of low-wage workers. Job loss should not be our only metric when assessing the impacts of minimum wage increases: this policy leaves the vast majority of low-wage workers better off.

The TD report’s authors rightly note that it is helpful to compare the minimum wage to the average or median wage. They also correctly identify that the minimum wage in Ontario will be around 63% of the median wage after the increase to $15 per hour.

They then state that this is too much and, as such, is a problem.

If the median wage is close to a poverty-line wage it is, in part, because wages for many workers have been growing far too slowly for far too long.

A minimum wage that is a higher proportion of the median wage is an argument for increasing the minimum wage: wage compression — less distance between those at the bottom and those at the top — is good!

Here’s the long and short of it: TD Bank’s analysis of the impact of Ontario’s bold move to a $15 minimum wage rehashes many of the same failed arguments. It is based on outdated economic research and skewed towards inflating the costs of $15 per hour while downplaying its many benefits.

Working people across Ontario should not take these claims at face value.

Michal Rozworski is a research analyst with the Ontario Confederation of University Faculty Associations and a CCPA research associate.