Right now, post-secondary students across Ontario are finishing up their studies for the year and heading off to summer jobs - if they have been lucky enough to land one.

New research from the CCPA demonstrates just how difficult it is to save up for tuition fees every year.

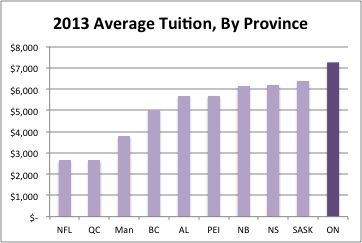

Ontario’s students face the highest average tuition in Canada, paying on average $7,259/year on tuition. Saskatchewan is next in line at $6,394. Newfoundland and Labrador have the lowest average tuition fees at $2,644.

Source: Tuition in Canada, Canadian Centre for Policy Alternatives. Retrieved from: apps.policyalternatives.ca

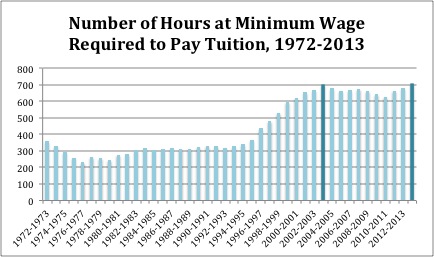

Not only is Ontario tuition the highest in the country, students across the country, Ontario included, must work far longer to pay tuition than students did in the past.

Students attending a post secondary institution in Ontario in the 1972-73 school year would have had to work 359 hours at a minimum wage job to pay for their tuition – that’s less than 9 weeks. That left students with a few weeks to earn money to pay for living expenses and incidentals during the school year.

In contrast, by 2013-14, students in Ontario had to work 708 hours at a minimum wage job just to pay tuition.

That means that students have to work the entire summer (18 weeks of full-time work) just to pay tuition. In other words, at minimum wage they can’t possibly earn enough to pay for food, rent, books or extracurricular activities, let alone earning enough money to pay for living expenses they may need to incur while they are working during the summer.

Source: Tuition in Canada, Canadian Centre for Policy Alternatives. Retrieved from: apps.policyalternatives.caIt’s a dramatic change that took hold in the mid 90’s when the average number of minimum wage hours needed to pay tuition increased dramatically – as a result of both a frozen minimum wage and rapidly rising tuition fees.

Furthermore, Ontarians aged 15-24 faced an unemployment rate of 15.7% in March 2014. That’s the highest rate across the country outside of the Maritimes. It’s also higher than the US rate, which sat at 14.5% in March 2014.

Taken together, it paints a pretty grim picture for Ontario’s young people. High unemployment and high tuition fees combined are saddling graduates with growing levels of student debt that make it difficult to take life’s next steps including purchasing a home, starting a family or even simply moving out on one’s own. It’s a looming crisis that continues to mount with no signs of relief.