In his fall economic update, Ontario Finance Minister Charles Sousa stuck to his commitment to balance the province’s budget next year.

The government has relied heavily on three austerity measures in the name of deficit reduction:

- It slapped a long-term freeze on public sector workers’ compensation. In fact, some workers haven’t seen a raise in six years.

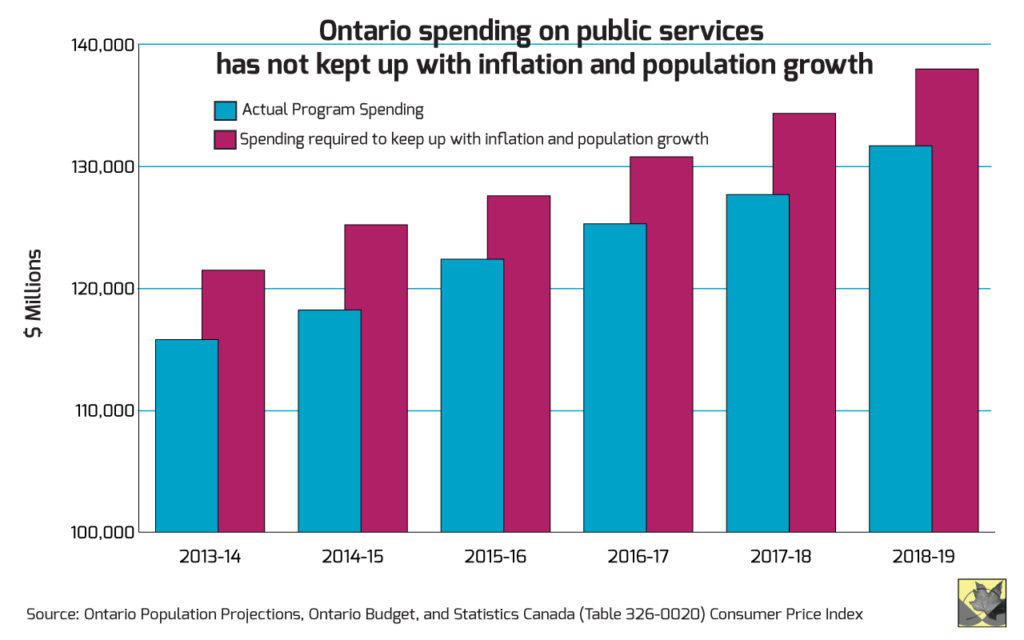

- It cut back on program spending: it hasn’t kept up with inflation and population growth.

- It sold off public assets, including the ill-advised sell off of Ontario Hydro.

The province has remained committed to capital spending in order to deal with pressing infrastructure renewal issues. These important investments increase employment in the short term and they improve productive capacity of the economy in the longer-term. With the passage of Bill 6, and commitments to community benefits agreements, these dollars can be spent even more effectively.

But with no ‘the deficit made me do it’ excuse in 2017, what should we be looking for in program spending, which has been squeezed over the last number of years?

To get back to real, per capita spending levels of pre-austerity 2011-12, the government will have to increase spending by five per cent — that’s an additional $6.3 billion in 2018-19.

That would mean the government would reverse its commitment in last year’s budget to keep growth in health care spending at a 1.8 per cent average between 2014-15 and 2018-19, and to keep education spending increases at 1.2 per cent. The $140 million increase in hospital budgets announced in the Fall Update is an increase of just over one quarter of one per cent.

The government is squeezing these services below inflation and population growth, at a time when the demands on the health care system are growing and the education funding formula continues to fail Ontario’s school system.

Now that the deficit dragon has almost been slayed, there is pressure from the right to maintain austerity in order to tackle the province’s debt. But, as I argued in my report No Crisis on the Horizon: Ontario Debt, 1990-2015, there is no need to panic.

And, the best way to reduce the debt to GDP ratio — the one that matters — is to keep the economy on a strong footing.

Increasing the money flowing into the government’s coffers is another way to keep Ontario finances moving in the right direction and maintain public services. The province needs to take a strong stance in its negotiations with the federal government to secure increased health transfers and funding for other public services.

And, the time has come to face the elephant in the room: after two decades of tax cut frenzy, Ontario has got a revenue problem.

Those tax cuts were politically appealing back when economic growth was in the 4-5 per cent range (those heady days of the late-1990s, early-2000s). But those days are behind us — slow growth is Ontario’s reality.

In a 2015 report, Kaylie Tiessen outlined options that Ontario has to increase revenues to pay for the services that we need. They included:

- Reversing the 2.5 percentage point reduction in the corporate income tax that took place in 2009. That could raise over $2 billion in revenues. And it would still leave Ontario with lower corporate income tax rates than comparable jurisdictions.

- Take up the room in the HST vacated by the Harper government by increasing sales taxes, and increasing sales tax credit to offset regressivity would do some very heavy lifting.

- The government could look at closing more tax loopholes (it made a start in last year’s budget), which would increase revenues, fairness, and simplicity all at the same time.

Sheila Block is a senior economist at the Canadian Centre for Policy Alternatives’ Ontario office. Follow Sheila on twitter: @SheilaBlockTO.