For those that feared that the Saskatchewan government would continue the punishing austerity they laid out in 2017, this year's budget came as a mild relief. While the 2018 budget doesn't restore the cuts made last year, the government appears to have opted for holding the line - offering no major tax increases while avoiding the litany of program cuts that outraged the public in the previous budget.

One of the first rules of politics is to define yourself before your opponent does it for you. This budget was the first act of newly-minted Premier Scott Moe's government that was guaranteed to receive public attention, and for a Premier who has yet to define himself or his government, replicating what was widely seen as a mean-spirited and unfair 2017 budget would have been to court political disaster. That a politician as adept as former Premier Brad Wall could not sell austerity to the public last year left little chance that a relative unknown like Scott Moe could. Certainly, this budget was a defining moment for Moe and his government, and they appeared unwilling to wear the public opprobrium that would have inevitably resulted from a continued slash and burn approach to the budget.

That being said, while the 2018 budget is more measured in that it doesn't replicate a 2017 budget that saw cuts and tax increases land disproportionately on the shoulders of the poor while simultaneously lavishing multiple tax breaks on corporations, it certainly doesn't do the more vulnerable in our province any favours. The province is suspending the Saskatchewan Rental Housing Supplement (SRHS), which will force the poorest in the province to devote even more of their meagre earnings towards rent. This continues the government's myopic focus on wrenching cost-savings from programs explicitly designed to support the poorest in the province. While the government did increase education spending by $30 million, it restores little more than half of the $54 million that was cut last year. School boards will be forced to find even more "efficiencies" in the classroom, even as student enrolment expands. As we have seen in the past, these "efficiencies" seem to fall disproportionately on special needs supports and programs.

If there is a small sliver of a silver-lining in this budget, perhaps it's the government's growing recognition that austerity during a downturn is bad economic policy. It's better to allow positive economic growth fight your deficits than deep cuts that can jeopardize positive economic growth, a point the CCPA Saskatchewan Office has been at pains to make over the past few years. After two years of negative economic growth, the economic assumptions in the 2018 budget are betting that a return to positive economic growth will do much of the heavy lifting of fighting the deficit. While this is welcome, it further throws into question the wisdom of the 2017 budget cuts and the government's embrace of austerity, all evidence to the contrary.

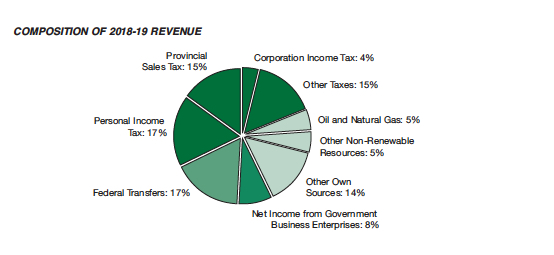

Also welcome is the government's recognition that its planned corporate and personal income tax cut reductions were ill-advised and unsustainable. But even with these walk-backs, the paucity of the government's current corporate income tax rate is reflected in the composition of revenues for the 2018 budget. As University of Saskatchewan Political Studies professor Charles Smith points out, the government received twice as much revenue from Crown Corporations ($1.1 billion) than all other corporations in Saskatchewan combined ($621 million). We would do well to remember this discrepancy, should the government float the desirability of further Crown privatizations in the future.

Simon Enoch is the Director of the Saskatchewan Office of the Canadian Centre for Policy Alternatives.