Canada faces significant and unpredictable headwinds going into 2019. Their source, and what we should do about them, however, depends on who you ask.

According to business lobby groups, the biggest threats to Canada come from uncertainty in our trade relationship with the United States, our relative tax competitiveness in the wake of Trump’s tremendous (as he would put it) corporate tax cut in January, and the effects of “burdensome” federal and provincial regulations on lagging productivity.

Alongside Finance Minister Bill Morneau’s economic advisory council, these groups are calling on the federal government to more or less ape the Trump agenda by cutting corporate taxes here, too, while softening environmental and other public interest regulations, all in an effort to attract investment.

But are these really Canada’s top priorities, with greenhouse gas emissions nowhere near as low as they need to be to avoid the worst of climate change, and with inequality continuing to chip away at the economic, political and social fabric? Are tax cuts and deregulation really the only options available to governments looking to support innovative new industries and jobs? No and no. Once again, we have an Alternative Federal Budget to prove it.

For the past 24 years, the CCPA has released the AFB just ahead of the annual budget, normally in late winter or early spring. In consultation with the dozens of organizations and academics who contribute to the project, we decided to move our release date to the fall this year so that we might feed directly into the budget-making process, inspire political parties of all stripes to put public money and resources to more effective use, and give activists and the public facts they can use to counter the corporate agenda.

On September 12, the powerful Business Council of Canada, representing CEOs from Canada’s largest corporations, released a doom-filled report claiming 4.9% of GDP and $20 billion in government revenues are at risk if big business doesn’t receive substantial new public subsidies. In the lobby group’s vision, this handout would be paid for through increases to personal income taxes and consumption taxes, and by finding “efficiency and effectiveness” gains in federal and provincial tax collection. That last part is never explained, but it sounds ominously like service cuts.

Canadians should be concerned about the competitiveness of the economy and our major industries. But cutting taxes and the programs they pay for is a failing strategy. Not only does austerity stunt growth, it has also clearly contributed to the worldwide rise in right-wing, anti-democratic demagogues.

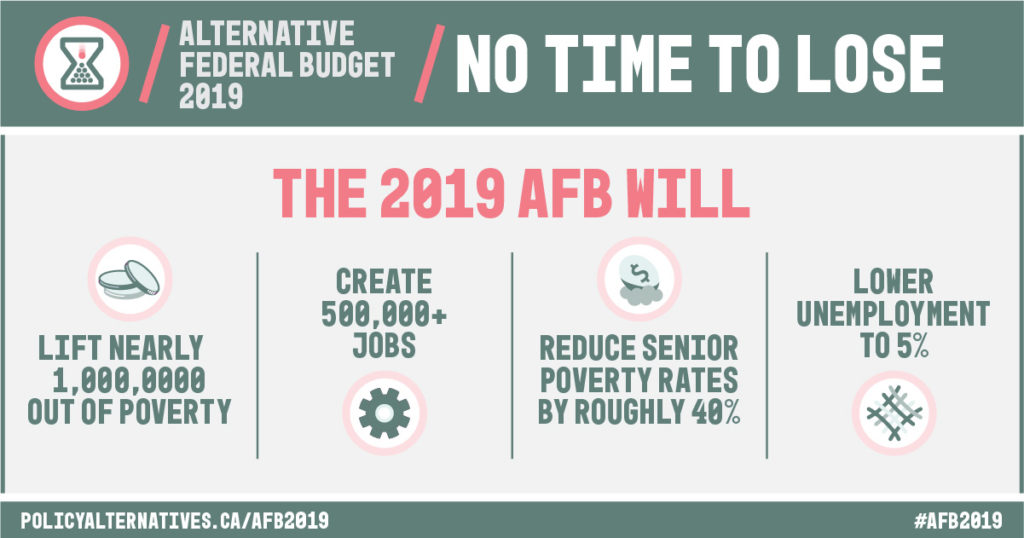

It would be much wiser, as the 2019 AFB proposes, to attract positive new ventures and promote sustainable economic activity by making strategic investments in our physical and social infrastructure—money that would make everyone’s lives better.

Economic sustainability and the just transition

By far the biggest threat to Canada’s economy in the medium to long term is not tax and regulatory competitiveness but global climate change. Occurrences of wildfires, floods and other extreme weather events associated with global warming are on the rise in every part of Canada and around the world. The rapid depletion of our natural environments and species extinguishment puts the need for better conservation measures high on the agenda.

To address these urgent challenges, Canada must rapidly transition away from fossil fuel dependence and toward a clean and sustainable economy. The AFB initiates a “just transition” plan for Canada aimed at lightening the blow that decarbonization will naturally have on fossil fuel workers and communities. That plan includes a new Sustainable Infrastructure Transformation Fund worth $6 billion over three years to provide resources for ambitious, projects in clean energy, transportation and building retrofits.

Part of the funding for this “just transition” will come from strengthening the federal carbon pricing backstop system, by continuing to increase the minimum carbon price by $10 a tonne annually after it reaches $50 a tonne in 2022 and closing some of the loopholes for highly polluting industries. The AFB also cancels all fossil fuel subsidies, which currently distort the true cost of the oil and gas industry, to recuperate $1.5 billion in federal revenues.

In 2018, there were 6,826 forest fires in Canada. That is 450% more than normal. Our Alternative Federal Budget provides fully costed solutions for a low carbon future.

When it comes to #ClimateAction , we have no time to lose.https://t.co/jbFQOhmWlF #cdnpoli #afb2019 pic.twitter.com/yvwORTiYDh— The CCPA (@ccpa) September 19, 2018

A “just” transition is impossible without meaningful reconciliation with Canada’s first peoples. While this agenda naturally transcends fiscal policy, there are simple measures the government can afford to take today that would begin to correct some of the outrageous imbalances in the federal-First Nations relationship and inequalities between settler and Indigenous communities across the country.

There is a $30-billion infrastructure gap on First Nation reserves in Canada, for example, reflecting needs in housing, water, roads and other construction projects. Economic development cannot happen without roads and broadband internet. To begin to correct this imbalance, the AFB invests $5 billion over three years in First Nations infrastructure.

Lest we forget the environmental impacts of economic development, the AFB redirects funds to enhance federal agencies that assess and manage toxic substances, including pesticides, and to revive the National Pesticides Monitoring Surveillance Network. A further $100 million will go toward establishing a network of marine protected areas, increasing research on and enforcement of increasingly controversial aquaculture projects, and protecting Canada’s migratory and resident birds.

Decent work and innovation

Inequality is not only unjust, it is a drag on the Canadian economy. Narrowing the gender employment gap, particularly among highly educated workers, would add 4% to real GDP, according to the International Monetary Fund. An estimated 608,000 women are working part time either involuntarily or because of caring responsibilities. Providing those women opportunities to enter the workforce in full-time jobs would increase payrolls by $17.7 billion a year. That money would ease family debt burdens and stimulate growth in the economy.

Likewise, young Canadians need more support navigating an increasingly precarious employment environment. Federal statutes pertaining to income security and labour are not responsive to the labour market realities of non-standard work (part time, contract, and with few benefits). The Canada Labour Code and Employment Insurance Act need to be updated to address the new insecure normal experienced by young and older workers alike.

To allay the very real short-term threats to the economy from U.S. taxes on Canadian imports, the AFB allocates $100 million toward a new adjustment fund for workers, industries and communities that are negatively affected. In the longer term, the federal government must engage constructively in broad public consultation on how to replace NAFTA and other free trade deals like it with a new, fairer and more sustainable trade and investment treaty model and negotiating process.

Additionally, stimulating innovation in Canada must start by making sure students of all ages have the education, training and supportive environment they need to prosper. The AFB eliminates tuition fees for all post-secondary programs, establishes a $1-billion Strategic Training Fund to bolster and diversify the workforce in key carbon-free sectors, and invests broadly in apprenticeships and training.

In general, the AFB aims to improve the safety net for workers impacted by big shifts in the economy and the way we work. The universal employment insurance entrance requirement, for example, will be set at 360 working hours under the AFB to level the playing field for precarious workers. The AFB also sets a minimum benefits floor for all unemployed workers (not just those with children), issues open work permits for the Temporary Foreign Worker Program (TFWP) and allows migrant workers to obtain parental benefits. Newcomers to Canada will benefit from greater access to training and accreditation, more support for resettlement programs and, for all migrant workers, a guaranteed path to citizenship.

Fiscal strength through progressive taxation

Decades of tax cuts have compromised the fiscal health of government. Federal revenues are presently 14.4% of GDP, much lower than the 50-year average of 16.4%. That might sound marginal, but this 2% difference amounts to $46 billion in 2019 alone. Canada doesn’t have a spending problem, it has a revenue problem.

The 2019 AFB prioritizes closing expensive tax loopholes (sometimes called tax expenditures) that benefit mainly Canada’s wealthiest income earners. These expenditures include the stock option deduction and preferences in the taxation of capital gains that cost the government $18 billion every year. Likewise, policymakers should consider an inheritance tax on estates valued above $5 million, in line with similar estate taxes in the U.S. and many other OECD countries. Such a tax would only apply to the top 0.5% of families (by income), but would generate $2 billion for public services and programs that benefit everyone.

Rather than finding new “efficiencies” at the Canada Revenue Agency, as proposed by Canada’s big business lobby, which would likely mean cutting staff and services, the government should continue to empower the agency to crack down on tax evasion and tax dodging. For example, a 1% withholding tax on corporate assets held in known tax havens could generate over $2 billion a year. Revenue can also be recuperated from foreign-based e-commerce firms (e.g., Google, YouTube and Netflix) that do not currently charge HST on the services they provide or ad money they collect in Canada (as their Canadian competitors are required to do).

Big business may want another corporate tax cut. But the reality is Canada’s existing tax regime is highly skewed in their interest. We propose that Canada should raise its top corporate rate to match the current U.S. rate of 21%. This, and a related increase in the small business tax rate to 15%, would generate revenues of $12 billion annually—money that could be reinvested in existing and new social services, as well as workforce development programs.

A more caring society

There is very clear evidence that investments in public services create jobs and improve quality of life. Yet as a country we are not investing enough in health care, child care, seniors care and affordable housing. We also know that the changing nature of Canada’s labour market means many workers are in precarious jobs, their employment instability having all kinds of negative social and health-related effects. But we are not doing enough to support those workers.

The AFB proposes a major expansion of federal public services and support programs—a subsidy for people, not the CEOs asking the finance minister for another handout. On health care, the AFB commits to a new Health Accord and Canada Health Transfer that grows at 5.2% annually. We allocate $7 billion a year to create a single-payer pharmacare plan that will create savings of up to $11.5 billion across the economy. And we implement a comprehensive, universal mental health program based on the principles and criteria of the Canada Health Act.

A national pharmacare plan, a seniors care strategy and fair federal funding for health care all included in @ccpa's Alternative Federal Budget https://t.co/WUkzLcBwUD #AFB2019 #Stand4Medicare #cdnpoli #cdnhealth pic.twitter.com/UH263hHncE

— Cdn Health Coalition (@HealthCoalition) September 19, 2018

Most comparable countries spend at least 1% of GDP on child care; Canada spends an estimated 0.5% annually. The federal government should increase child care funding by $1 billion a year until the 1% (of GDP) benchmark is reached. That funding should go directly to public and not-for-profit providers to reduce child care fees for parents. The AFB spends a further 2% of GDP on universal home care, again based on principles and criteria set out in the Canada Health Act.

While the federal government has announced it will launch a promising Canada Housing Benefit in 2020 to help low-income households afford their rent, the AFB accelerates its implementation. We immediately put $1.5 billion toward the benefit and launch it next year (2019), which would help an estimated 250,000 people afford their rent in the first year. The AFB puts a further $1 billion toward a new annual fund for supportive housing on the basis that a secure, affordable place to live is a necessary first step for people to participate in the workforce and their community.

Like with housing, the federal government has made several important policy changes that impact poverty in Canada. We need to build on that momentum. The AFB seeks to lower the poverty rate by 50% from 2015 levels within three years. It introduces a yearly $4-billion transfer to the provinces and territories to boost social assistance benefits and achieve clear poverty reduction targets. It increases direct transfers to low-income families, including a new “Dignity Dividend” that would reduce child poverty by a quarter and adult poverty by 10%. The AFB also adds $1,000 a year to the Guaranteed Income Supplement (GIS) and expands the Canada Pension Plan (CPP) replacement rate to 50%.

No time to lose

Budgets are political documents—they are about choices and values. And the choices we make today will determine the long-term sustainability of our society and our economy for generations to come. Given the threats and uncertainties on the horizon, there is no time to lose in choosing to budget more equitably and cost-effectively—so that we are in a better position to face those challenges head on.

Last year’s budget introduced a new gender-based analysis plus (GBA+) framework to understand how all government decisions affect people differently, with a view to making better decisions and allocating resources more equitably. This framework is a starting point for tackling inequalities based not only on gender identity, but also race, class, sexuality and ability. The government should also be commended for proposing legislation to ensure that future budgets keep the focus squarely on closing gaps and creating greater opportunities.

Unfortunately, a narrow focus on corporate taxes and preserving the status quo in the lead up to the fall fiscal update and 2019 budget ignores the magnitude of the challenges facing Canada and indeed much of the world: climate change, inequality in all its forms, and precarity. The AFB proves we have affordable, achievable options for addressing all of these challenges, as significant as they are.

The AFB continues to show that by focusing on people, the government's fiscal power can be used in more egalitarian and democratic ways. We have the means to encourage strong, sustainable growth in climate-friendly industries while providing strong public programs that support our economy and make all our lives better. We should exercise those means.

Stuart Trew is Editor of the Monitor, the CCPA’s bimonthly magazine. To read the whole AFB visit www.policyalternatives.ca. The September/October issue of the Monitor is available for download here.