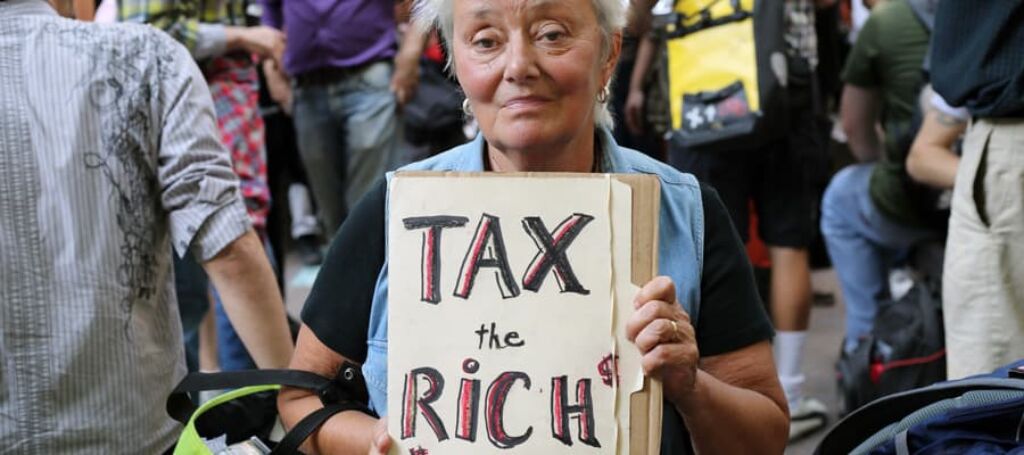

If anything is clear in this pandemic, Canada needs a wealth tax on the super rich to rein in extreme inequality and contribute to crucial public investments in the wake of COVID-19. A wealth tax is economically and technically feasible, but it requires breaking with a status quo that often too narrowly serves Bay Street and the wealthy few.

Wealth—or net worth—for an individual or household is the sum of all assets (real estate, financial investments, car, etc.) minus all debts (mortgage, credit card, student loan, etc.).

The sharp rise in inequality in recent decades has become increasingly evident in Canada and many other countries, and wealth inequality reaches even greater extremes than income inequality. As the CCPA has documented, Canada’s 87 richest billionaire families control 4448 times more wealth than the average family and as much as the bottom 12 million Canadians combined. A growing body of research shows that extreme inequality puts a drag on economic growth and worsens health and social outcomes across society.

The COVID-19 crisis has shone a light on a simple truth: no individual or corporation becomes wealthy without an enormous collective effort, both by workers and through public investments in social and physical infrastructure.

In this important sense, the massive wealth of this country belongs to all of us. If we can harness this wealth, we’re more than rich enough to tackle the climate crisis, transform our broken seniors’ care system, bring in universal affordable child care and Pharmacare, and ensure housing for all.

A wealth tax on the richest few is an important tool to build the future we need, instead of going back to the way things were pre-pandemic. It’s a policy whose time has come.

Taxing the super wealthy has the backing of a growing body of economic research. French economist Thomas Piketty most famously brought the wealth tax to prominence in his 2014 book, Capital in the Twenty-First Century. Berkeley economists Emmanuel Saez and Gabriel Zucman, among others, have since developed the research case for wealth taxation in more detail. Wealth tax policy proposals have proliferated in the US, Canada, Spain and at an EU-wide level in recent months.

Piketty shows that profits from capital ownership are outstripping economic growth itself, raising alarm bells about the increasing concentration of wealth and power among the super-rich globally. Those who gain income from their holdings of existing wealth—rather than those who earn income from their labour—are amassing more and more.

The idea of a wealth tax enjoys strong public support, at levels rarely seen on any public policy issue. The latest Abacus poll in Canada—commissioned by the Broadbent Institute—shows 75 per cent public support and only 14 per cent opposition to such a wealth tax, including 69 per cent support among Conservative Party voters. This is consistent with previous Canadian polling on the issue, as well as opinion research in the US and elsewhere.

What would a wealth tax look like in Canada?

A proposal put forward by the NDP in last year’s federal election would apply a 1 per cent annual tax on net wealth over $20 million, meaning the first $20 million of any household’s wealth is exempt from the tax. The Parliamentary Budget Office (PBO) estimated that this would raise $5.6 billion in the first full fiscal year, rising to $9.5 billion per year by 2028.This proposal was timid compared to the Elizabeth Warren and Bernie Sanders wealth tax plans in the US. Warren’s policy would apply twice that rate (2 per cent) on wealth over $50 million and 3 per cent over $1 billion. In Sanders’ plan, the 3 per cent rate kicks in at $500 million and rises to 8 per cent over $10 billion of wealth. Saez and Zucman estimate that Sanders’ plan would raise $435 billion per year over 10 years in the US. Polling last year showed overwhelming support from Canadians for a wealth tax with 2 per cent and 3 per cent rates applied at the $50 million and $1 billion thresholds, as found in the Warren plan.

Many ask, would a wealth tax really work in practice? Saez and Zucman make a strong case that it would.

By design, a modern wealth tax would apply to the worldwide assets of any Canadian citizen or resident above the established threshold (similar to how the US requires citizens to pay taxes even if they live and work abroad, with a credit applied for any foreign tax paid). Legally shifting funds to low tax jurisdictions won’t get you out of it.

Some critics raise concerns that the wealthy will instead go so far as renouncing their citizenship to avoid the tax. To address this, a much steeper “exit tax” would apply to their wealth at that time, which is set at a rate of 40 per cent in the Warren and Sanders’ plans and could be set at a similarly robust rate here.

Perhaps of most concern, the super rich could engage in outright illegal tax evasion, flouting the law to hide or misreport their wealth in tax havens. Ramping up tax enforcement and cracking down on tax avoidance and evasion is critical to make a wealth tax work. Indeed, this should be done with or without a wealth tax. The PBO recently estimated that investing an additional $750 million in tax enforcement would raise federal tax revenues by about $3 billion, along with an additional boon to provincial revenues.

As Saez and Zucman emphasize, we largely know how to crack down on tax havens. Key elements include targeting the financial services industry that helps enable tax avoidance and evasion, stronger data transparency requirements for banks, and greater resources and penalties for tax enforcement. What’s needed is political will.

One other important aspect of a modern wealth tax is that it be applied comprehensively to all types of assets, so there is no benefit to shifting wealth between different types of assets to avoid it. This is a lesson from some older European wealth taxes, which often exempted certain asset types like primary residences. This was typically done with the intention of protecting the middle-class because these taxes applied at much lower wealth thresholds. A wealth tax focused on the super-rich avoids these concerns by exempting the middle-class altogether and sidestepping any need to exclude certain types of assets.

A wealth tax is only one of the tools available to reduce inequality, expand public services, and help pay for the major costs of COVID-19 crisis. In terms of taxation, additional policy tools include an excess profits tax, corporate tax reform, raising the capital gains inclusion rate, and closing a proliferation of tax expenditures that mainly benefit the affluent.

Beyond taxation, a whole host of other reforms are needed to take on extreme wealth and economic power, including strengthening workers’ rights and advancing new models of public and worker ownership. But a substantial wealth tax on the super rich would represent a major step forward.

Given the increasing recognition of our deep interconnectedness in the modern economy and the gross unfairness of extreme inequality, it’s no surprise that policies like a wealth tax enjoy such strong public support. It’s clearer than ever that our prosperity is something we create together and doesn’t belong solely in the hands of a wealthy few. While the economic and political power of the super rich is substantial, when a policy like a wealth tax has overwhelming public support, if people get organized to demand it, change is within reach.

Alex Hemingway is an Economist and Public Finance Policy Analyst at the CCPA’s BC Office. Follow him on Twitter @1alexhemingway.