It’s accepted wisdom that an undergraduate degree is the new high school diploma – it’s the ticket into the workforce.

But that ticket comes at an unrelentingly steep price: average tuition and fees in Ontario are the highest in the country, with no sign of abating.

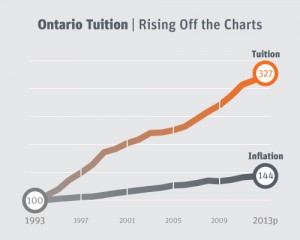

While tuition fees are increasing all across Canada, Ontario’s have tripled -- an increase way, way beyond the rate of inflation, as the following chart shows.

Ontario tuition and other fees are estimated at $8,474 this year and they’re expected to climb to $9,483 by 2017 – a 12 per cent increase, making Ontario consistently the most expensive place in Canada to try to get a ticket into the workforce.

Why is this happening? The simple answer is that government is allowing it to happen.

We, as taxpayers, used to foot a larger portion of the cost of university tuition but, because of government policy, a greater share of that burden is being foisted onto students, saddling many with crushing debt and putting university out of reach for many low- and middle-income families.

What does a higher price tag mean? There are many decision points for a high school student eyeing up university. One of those is: what can I afford? It’s an easy question to answer for parents who can cover all or most of the cost of their child’s education.

For those who aren’t so lucky, Ontario’s average tuition fees invite substantial sticker shock and fears of being saddled with mortgage sized debts at the same time as they’re faced with finding a job.

And if current youth unemployment numbers hold, that’s a risk that fewer lower- and middle-income youth will be willing to take.

For a province that needs to position itself to compete in a global knowledge economy, a high tuition fee policy is too steep a price to pay.

Jennifer Story is the Communications Director of the CCPA Ontario Office.