The coronavirus has brought about a global public health and economic crisis with breathtaking speed. In Canada we are entering a time of emergency on a scale that is difficult to fully comprehend or anticipate. The pandemic has quickly exposed the gaping holes in our social safety net—particularly with respect to work and income security—and deep inequalities that leave people exposed to even greater hardship due to poverty, homelessness, isolation and other forms of vulnerability and injustice.

The crisis we now face is fundamentally a collective one: our ability to weather and recover from it hinges not only on sweeping public health measures but more broadly on our ability to take rapid and bold action through our governments and public sector, at all levels. In an emergency like this, everyone becomes a socialist—across the political spectrum, people see a renewed value in public services, we come to a new understanding of the role of government, we reject the fetishization of “balanced budgets,” and we come to deeply appreciate that our fates are all linked, that if the poor and vulnerable are not cared for, the consequences impact us all.

In writing this piece, we recognize that political and government leaders are struggling to make sense of a rapidly-changing situation and grappling with the challenge of deploying public services at a time when social distancing is the number one public health strategy. We are encouraged by early moves by the federal government, which yesterday announced significant improvements to income security programs, including two new benefits for workers who wouldn’t normally qualify for EI. It has also been encouraging to hear BC Premier Horgan state that he sees his core job as delivering services to people, not avoiding deficits at their expense. Indeed, British Colombians themselves are the core of our economy — keeping ourselves safe and meeting our needs is a direct investment in our economic future. What else, after all, should an economy fundamentally be for?

This moment calls for government responses that are bold, courageous and forward-looking. It is increasingly clear that we are in for a prolonged and deep recession, and that extraordinary actions will be needed to marshal resources during the immediate emergency and in order to rebuild once it has passed. As we navigate this period, it is important to ensure that the immense amount of money and other public resources about to be made available reach all who need them. It is also important to think about the longer term consequences of our actions today—will they help create a more resilient and just society, or will they replicate the very inequities that are worsening the pandemic’s impacts right now (like gig work and homelessness to name just two)?

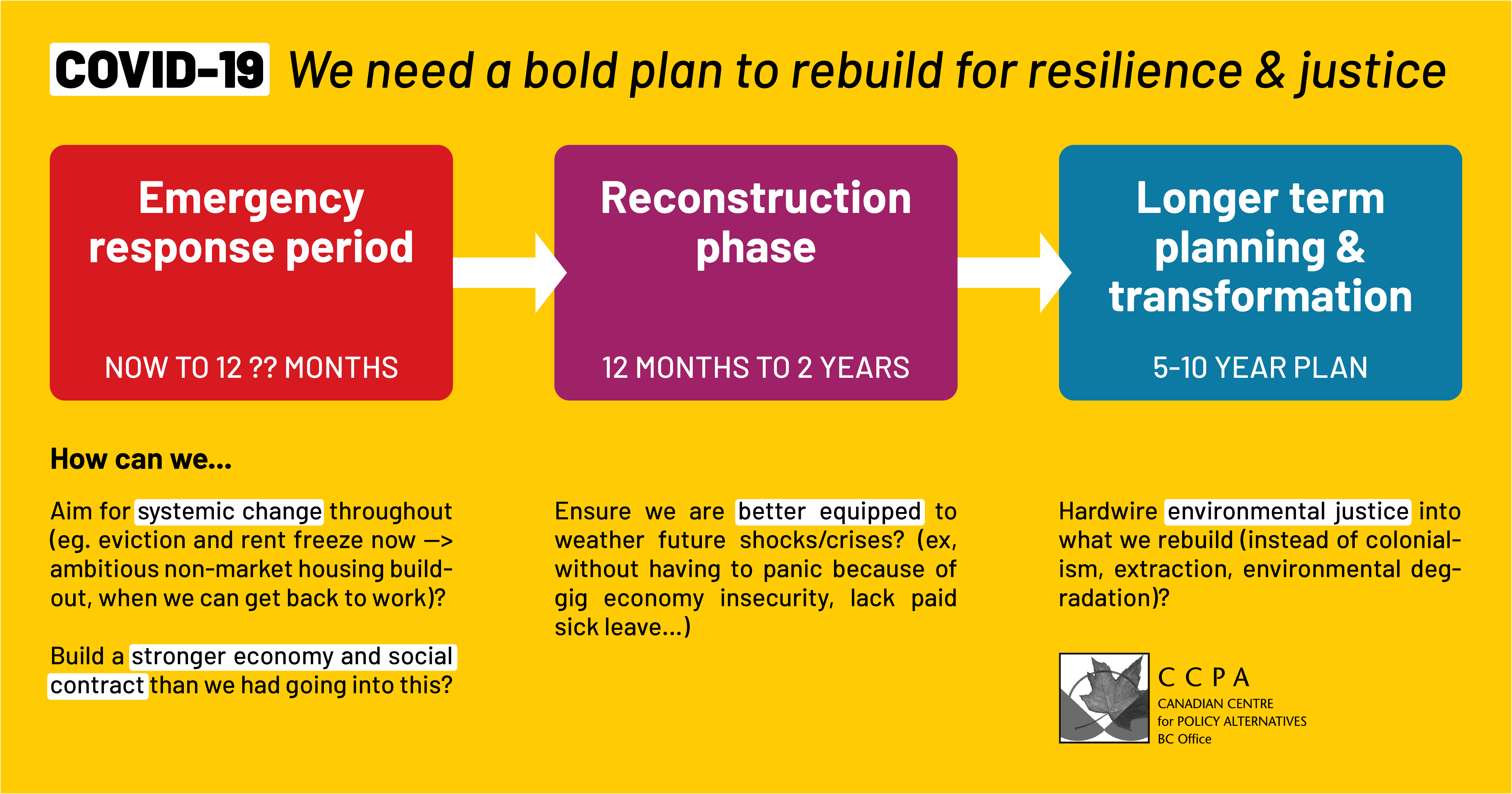

In considering how governments should respond to the pandemic, it is helpful to think about three phases of action: the emergency response plan we need now, the reconstruction phase we will need three to twelve months from now, and the longer term rebuilding required over the years to come. Measures that would be unthinkable just weeks ago — border closures, school closures, mass movement of workplaces to virtual operation—are being taken in order to contain the virus. We should be equally brave when it comes to economic and social measures — now and throughout the reconstruction and rebuilding to come.

Right now we are focused on the emergency plan phase. Turning large institutions and systems on a dime is difficult at the best of times. In the midst of disruption when as many people as possible need to self-isolate is a monumental task. And we thank everyone directly involved in that effort, from elected leaders to those working on the front lines of health, community and social services.

With that in mind, we offer some thoughts on key initial economic and social service measures that we’d like to see taken up specifically at the provincial level. Normally in a recession governments stimulate the economy using measures designed to kick-start economic activity and get people working—but in a pandemic where large swaths of the labour force need to stay home, the focus initially must be quite different. The two primary tasks during this emergency phase are 1) to put and keep money in people’s pockets and protect small businesses, and 2) to meet the needs of people who are vulnerable due to existing injustices like poverty. BC has ample economic and fiscal capacity to act, and there is no reason to be concerned about running large deficits at this time.

Emergency measures to put and keep money in people’s pockets and protect small businesses can include:

- Immediately and significantly increase social assistance and disability rates, relax eligibility restrictions and eliminate work search requirements.

- One key mechanism for getting money in people’s hands over the coming months is through existing tax credit programs. BC should increase the provincial Sales Tax Credit and Climate Action Tax Credit and expand eligibility, which would nicely build upon the federal government’s moves to boost the GST credit and Canada Child Benefit. We note that a limitation of using tax credits is that eligibility is based on a person’s income from the previous tax year, so this tool isn’t necessarily responsive to loss of income due to the current crisis (and not everyone files taxes). Other emergency income measures should also be on the table.

- Guarantee paid sick leave for all workers, including waiving doctor’s notes requirements.

- Increase monthly payments via the Rental Assistance Program and Shelter Aid for Eldery Renters (SAFER) program and make them available to more households.

- For 2020, implement a rent freeze across all rental housing units, and also move to fast-track the implementation of permanent vacancy control to limit increases in housing costs for renters now and in future. (In the medium to longer term, this would need to be complemented by a commitment to massive and ongoing public investment to address the shortage of rental housing, beginning as soon as people are able to get back to work.)

- Rapidly implement a moratorium on foreclosures and evictions for non-payment of rent.

- Create a COVID-supports line for information and help accessing income supports and finding out about other emergency measures and protections people have access to (in addition to the dedicated COVID health information line that has already been established).

- Allow households, small businesses and non-profits to defer their property tax.

- As theatres and other public spaces close down, special supports are needed for all manner of performers and others whose incomes are tied to the arts and public events.

- Implement a freeze on evictions and foreclosures to protect small businesses unable to meet their immediate rent or mortgage payments.

- Moratorium on all utility disconnections for individuals and small businesses.

- Create a zero-interest loan guarantee fund for small and medium sized businesses to be deployed by BC credit unions (with funding attached to cover credit union lending costs).

- Develop a multi-faceted response that ensures social distancing doesn’t turn into social abandonment for many vulnerable people.

- Provide funding, goods (especially food and medical supplies) and information resources to support Indigenous communities in developing and implementing their response plans. Reach out to and provide parallel support to urban Indigenous organizations and their partners.

- This would include an emergency response plan for the Downtown Eastside and other people at severe risk to maintain critical services and supports, as well as providing emergency housing for those without shelter and who cannot self-isolate. This could include requisitioning empty hotel space to provide housing for populations experiencing homelessness, as is currently occurring in jurisdictions like California.

- Provide emergency grants to non-profit agencies to help them increase community services and restructure service provision models as they deal with the impacts of social distancing and workforce disruptions. These should be deployed using a simple, fast-tracked application process for agencies.

- As part of the emergency grants fund, dedicate resources to legal aid and advocacy groups to provide information and advocacy to people in crisis or needing help navigating government services and systems.

- All health care services should be available free of charge regardless of citizenship, including migrant and undocumented people and families.

- Prescription drugs should likewise be available free of charge to everyone who needs them through an expansion of Fair Pharmacare.

- Private surgical space could be taken under public control to add to health care system capacity.

Shannon Daub is Director of the CCPA- BC office. Alex Hemingway is an Economist and Public Finance Policy Analyst at the CCPA’s BC Office. This blog also appears on Policynote.