This weekend's announcement of a plan for a “Universal Tax Cut” by the Conservative party signalled the first major tax discussion of Election 43. The basic premise of this plan is to reduce the rate in the lowest federal income tax bracket from 15% to 13.75% gradually over a three year period. The non-refundable tax credit rate would be reduced to match. The plan would be fully implemented in 2023. The Parliamentary Budget Office’s costing assessment of the tax credit is available here.

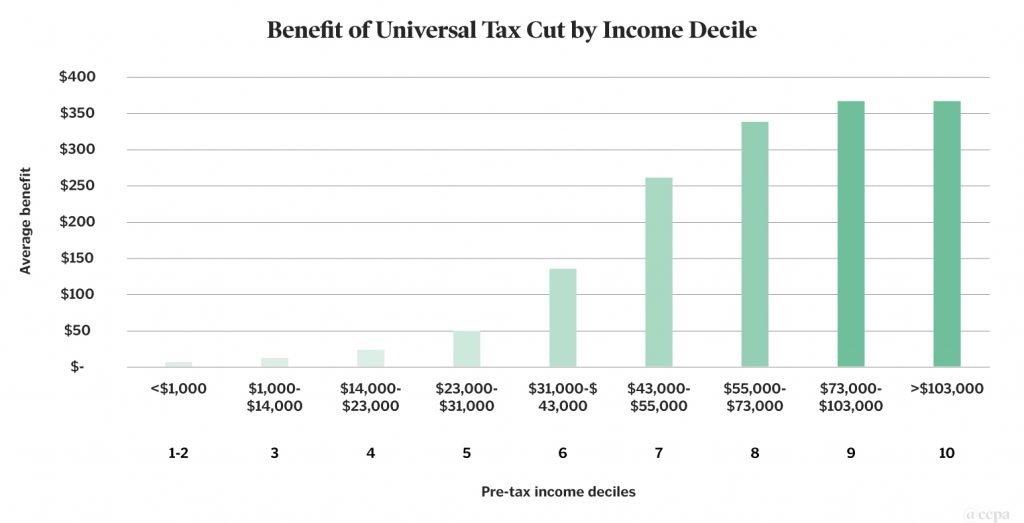

Does the name "Universal" mean that everyone everyone would get this benefit? No. In order to be eligible, Canadians would have to be paying taxes to benefit, as with any change to the tax brackets like this. Further, the full benefit of this tax cut goes to people with incomes in the top deciles of the bracket. So an individual would need to make over $52,000 per year in 2023 to reap the full benefit of this cut. That benefit is hypothetically $490 per person, but the average benefit, even for the top filers, is more likely to work out to $370. It’s really only the top three deciles of tax-filers that can even expect even that average of $370 a year. The bottom third of taxpayers, on average, get essentially nothing as they don’t pay any income tax and can’t benefit. The middle third of taxpayers see some benefit, but less than the maximum as they don’t make over $52,000.

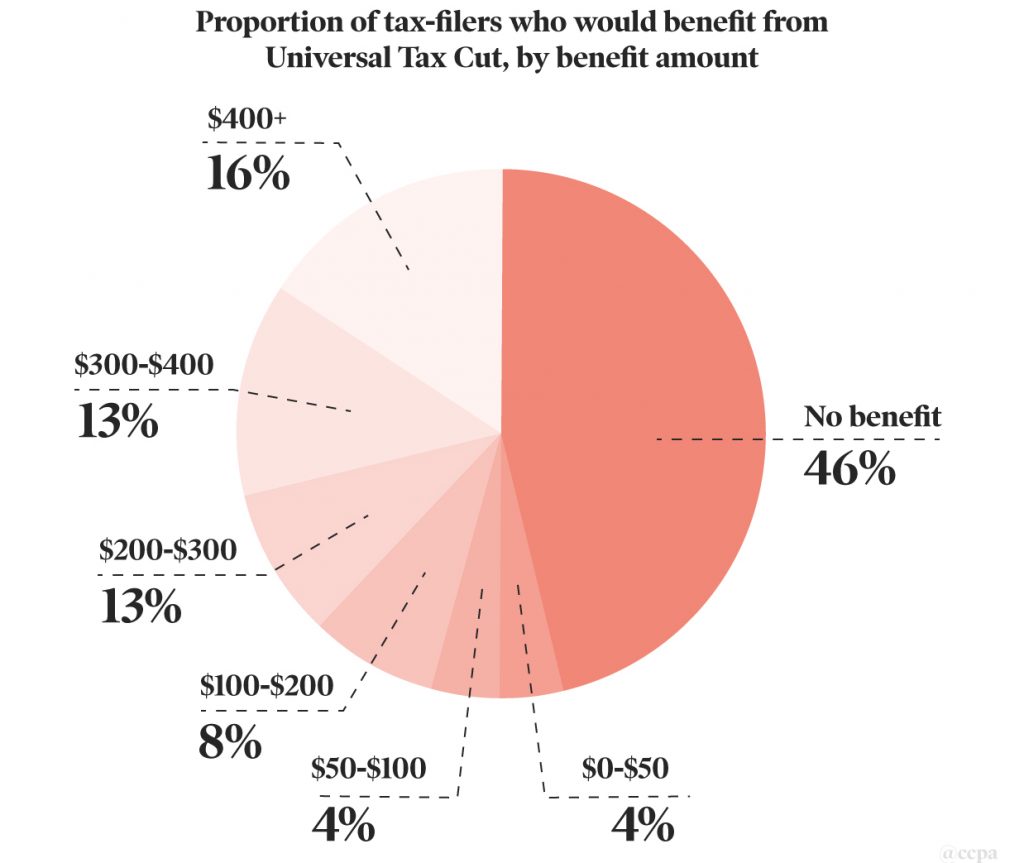

A little under half of tax-filers see no benefit from this tax change (46%). Although getting the full benefit of $490 isn’t terribly common, 16% of tax-filers would receive over a $400 reduction in their taxes. Again, these gains are concentrated among people receiving the highest incomes in Canada.

As with any tax cut, there are three options as to how to pay for it: tax increases elsewhere, program cuts or increases in the deficit. As policy changes go, this plan's $6 billion annual price tag by 2023 is expensive and would require significant changes in program funding, taxation or deficit growth in order to pay for it.

David Macdonald is a senior economist with the Canadian Centre for Policy Alternatives. Follow him on Twitter at @DavidMacCdn.

The CCPA has done extensive research and analysis on a wide range of federal policy issues, most notably through our annual Alternative Federal Budget. As we head towards the October 2019 federal election, we’ll be sharing our independent, non-partisan analysis and fact-checking of campaign promises and platforms from all the major parties.