Forestry, and the associated pulp and paper industry, have played second fiddle to oil and gas in the apocalyptic symphony that is the climate crisis. That is beginning to change as the contribution of deforestation to global greenhouse gas (GHG) emissions and biodiversity loss becomes clearer to more and more people and their governments. The Amazon rainforest now emits more carbon than it can absorb, for example. Canada’s boreal forest, the world’s largest intact forest ecosystem, stores hundreds of billions of metric tonnes of carbon, but our forests have also been net emitters since 2001.

Reducing our consumption of forest products and more strictly regulating logging and other industry practices must be core elements of any GHG reduction strategy and just transition to a sustainable future. While the sector provides high-paying jobs for thousands of Canadians and substantial provincial revenues through stumpage fees, the sustainable management and conservation of forestry resources must be decided democratically and in consultation with Indigenous nations and communities—not based on the profit motives of a consolidating global industry.

Unfortunately, a ubiquitous feature of Canadian trade deals stands in the way of this transition: investor-state dispute settlement (ISDS). ISDS is a system of private arbitration available to foreign investors for settling disputes with governments over public policy choices, legal outcomes, and other measures taken by state actors. ISDS can be found in dozens of international investment treaties and free trade deals signed by Canada. While most people and domestic companies must go to the courts to challenge government decisions, ISDS gives foreign investors a privileged option more favourable to their interests.

“Canada’s model investment treaty language does not adequately control for outrageous and growing awards for multinational corporations in ISDS proceedings.”

Canada has been sued four times by U.S.-based forestry, pulp and paper firms under the expiring investment arbitration rules of the North American Free Trade Agreement (NAFTA). Total claims in these cases, which challenged public policies related to the production and management of forest resources, surpassed $1 billion USD, while Canada ultimately paid out $131 million USD in awards or settlements. The threat of such claims can deter governments from enacting policies that undermine corporate interests.

Canada was wise to remove ISDS from the renegotiated Canada-U.S.-Mexico Agreement (CUSMA), or “New NAFTA,” as it is sometimes called. But the government, on behalf of powerful mining, finance and fossil fuel interests, continues to pursue nearly identical rules in a slate of new treaties with Asian countries such as Indonesia, home to one of the world’s largest paper industry giants. Including ISDS in Canada’s planned trade deals with Indonesia and the Association of Southeast Asian Nations (ASEAN) will only undermine forestry management and other environmental policies on both sides of the Pacific.

Forestry-related NAFTA claims push limits of ISDS

The CCPA has been tracking Canada’s ISDS record for some time in reports on cases filed against Canada (almost all of them under NAFTA) and Canadian investor-state cases filed abroad. The latest editions of these reports are Scott Sinclair’s “The Rise and Demise of NAFTA Chapter 11” (April 2021) and Hadrian Mertins-Kirkwood’s “On the Offensive: How Canadian companies use trade and investment agreements to bully foreign governments for billions,” published earlier this year.

The threat of costly forestry related ISDS lawsuits is not hypothetical. Up to 2021, Canada was the most sued of the three North American countries under NAFTA’s ISDS process. About two-thirds of those cases related to environmental or natural resource measures, with four coming from forestry, pulp or paper companies. The AbitibiBowater case, discussed below, shows how firms will use ISDS as leverage to reach favourable outcomes at the public’s expense, or expand private property rights beyond what the law allows, or create a policy chill on future governments.

In total, seven forestry-related NAFTA investor-state lawsuits have been brought against Canada and the United States, with five resulting in awards or settlements. These cases, discussed below, show the vast breadth of government measures that can be challenged outside of the courts in private arbitration under treaties like NAFTA or the proposed Comprehensive Economic Partnership Agreement (CEPA) with Indonesia. They also show how tribunals considering similar matters can come to strikingly different conclusions about what the investment treaties say and the limits of government policy space.

Pope & Talbot v. Canada (1998)

In this highly cited case filed in 1998, the U.S. forest products company Pope & Talbot challenged a lumber export quota system put in place in four provinces as part of the 1996 softwood lumber agreement between Canada and the United States. In its claim, the company said the quotas were handed out unfairly, in violation of NAFTA’s non-discrimination and minimum standard of treatment (MST) guarantees for foreign investors. It also claimed the export quota increased the price of woodchips in B.C., which harmed the firm’s paper facility in the province.

The tribunal came to a number of startling conclusions, including that investment claims could arise from disputes involving trade in goods (though not in this case), and that it was not relevant that Canada had implemented the export quotas as part of an international trade treaty. Another NAFTA investment dispute running parallel to this one (S.D. Myers v. Canada) similarly discounted Canada’s international environmental obligations when deciding that a temporary export ban on PCBs—a synthetic compound used in electrical components until the 1970s—violated the U.S. firm’s national treatment and MST rights.

Though the tribunal in Pope & Talbot ultimately rejected the company’s national treatment arguments, it worryingly claimed that a government measure that applied to companies of any nationality might still violate NAFTA if the measure in question undermines the treaty’s liberalizing objectives. Also disturbing was the tribunal’s finding that NAFTA’s MST clause had been breached by a superficial bureaucratic requirement related to the production of documents during a federal lumber quota review in 1998. The tribunal awarded the firm $461,566 USD for costs associated with that mundane review.

“ISDS gives already-litigious resource companies additional avenues for getting their way in policy.”

Canada, the U.S. and Mexico have consistently argued that MST violations should involve much more severe breaches of customary international law on the treatment of foreign nationals. In 2001, the NAFTA parties inked a statement to that effect in an attempt to limit the ability of ISDS tribunals to freelance much more expansive definitions of what constitutes unfair treatment. That statement, like other clarifying language in Canada’s post-NAFTA trade and investment treaties, has had inconclusive effects on arbitral panel rulings.

Canfor et al. vs. U.S. (2001)

In three separate and eventually consolidated claims, several Canadian forestry companies challenged U.S. countervailing duties and anti-dumping measures applied to imports of Canadian softwood lumber. Canada and the U.S. have long disagreed whether Canada’s relatively low stumpage fees, paid by firms to provinces for the right to log, constitute an unfair subsidy. Two separate World Trade Organization dispute panels have sided with Canada on the matter, but with no noticeable shift to U.S. policy.

The NAFTA lawsuit from the Canadian forestry firms was settled in 2006 before the tribunal could consider the merits of the case. The settlement was part of another softwood lumber agreement signed that year by the Canadian and U.S. governments. By that point in the arbitration, the tribunal had agreed with the U.S. that “the entire [NAFTA chapter 11] does not apply with respect to the antidumping law and countervailing duty law of a State Party.”

However, arbitrators claimed they had jurisdiction to hear the companies’ complaints about an amendment to those measures that was allegedly not properly notified to the Canadian government as required in chapter 19 of NAFTA, which contains the dispute settlement process for contesting trade remedies decisions in Canada or the U.S. The tribunal also held that the facts brought forth by the claimants were “prima facie capable of constituting a violation of the substantive obligations of the United States” under NAFTA’s investment chapter.

Merill & Ring vs. Canada (2006)

This forestry-related case was the first to be heard following the agreement by Canada, the United States and Mexico with respect to the limits of NAFTA’s minimum standard of treatment (MST) clause, as mentioned above. Merrill & Ring claimed that Canadian federal and provincial regulations restricting the export of unprocessed logs—measures excluded by Canada from NAFTA’s trade in goods obligations—favour log processors in B.C. at the company’s expense, expropriate its investment in B.C. timber lands, and violate NAFTA’s MST guarantee.

In its 2010 decision, the tribunal dismissed all the company’s claims, but still pushed the boundaries of NAFTA’s MST protections beyond what Canada, Mexico and the U.S. had insisted in their 2001 joint interpretation. Customary international law had evolved, the tribunal said, to the point that foreign nationals engaged in business, trade and investment are protected from a wide range of state conduct that could be seen as “unjust, arbitrary, unfair, discriminatory or in violation of due process…even in the absence of bad faith or malicious intention.” As there are no fixed legal definitions for arbitrariness or vagueness, ISDS tribunals have considerable leeway to make up their own.

AbitibiBowater vs. Canada (2009)

AbitibiBowater (now Resolute Forest Products) is one of the world’s largest pulp and paper firms. In November 2008, a few months before filing for bankruptcy, the firm announced it was closing its last remaining pulp and paper mill in Newfoundland and Labrador, where it had operated mills for 100 years. The province passed a law to expropriate the mill’s lands and assets, on payment of fair market value, and revoke AbitibiBowater’s access to timber and water rights that belong to the Crown.

The company launched a NAFTA investor-state arbitration in April 2009, claiming the provincial law violated the treaty’s national treatment, most-favoured-nation treatment, MST, and expropriation articles. In August 2010, the federal government settled the claim before it could go to arbitration, paying AbitibiBowater $130 million to walk away from the case and focus on its bankruptcy proceedings.

“An international forestry giant was compensated for land and timber rights which legally belong to the people of Newfoundland and Labrador.”

The settlement set a highly worrying precedent because it “compensated the forestry giant for the loss of water and timber rights on public lands, which are not normally considered compensable rights under Canadian law.” It also highlighted how investment treaties signed by Ottawa can roll over the rights of provincial and territorial governments to regulate publicly owned natural resources to benefit their citizens. Shortly after, for example, Canada settled another NAFTA case involving the rejection of a highly unpopular quarry proposal in southern Ontario in exchange, it seems, for a $15 million payout from the province.

In the AbitibiBowater case, the settlement also emphasized the huge differential in the rights conferred to business through ISDS and their responsibility to the communities in which they operate. An international forestry giant was compensated for land and timber rights which legally belong to the people of Newfoundland and Labrador, with the federal government promising to recoup the money from the province. Meanwhile, the province was left to cover the costs of severance for laid-off workers and environmental remediation at five contaminated sites, estimated at between $50 and $100 million.

Resolute Forest Products vs. Canada (2015)

In its second NAFTA case against Canada, Resolute disputed a package of financial and tax incentives provided by the Nova Scotia government and independent energy regulators to the successful B.C.-based bidder for a struggling Nova Scotia paper mill, Pacific West Commercial Corporation (PWCC). The U.S.-based Resolute claimed the measures, introduced in 2012, undermined the competitiveness of its competing Quebec paper mill in contravention of NAFTA’s national treatment and MST obligations. Resolute demanded $121.4 million USD in compensation for lost earnings—close to what the company had won as a settlement in its earlier NAFTA dispute in Newfoundland and Labrador.

The tribunal accepted jurisdiction to hear the case on the grounds that the Nova Scotia measures were “sufficiently proximate,” if “close to the line,” to Resolute’s business to warrant a hearing. But a majority (two out of three arbitrators on the tribunal) eventually found that most of the impugned incentives were either procurements or subsidies excluded from NAFTA Chapter 11’s national treatment rules. The same majority decided that Resolute and PWCC could not be said to be “in like circumstances,” even if they produced similar products, since Resolute’s competing mill was in Quebec, outside of the reach of Nova Scotia’s regulatory reach.

As the tribunal pointed out, Resolute was itself a beneficiary of Nova Scotia’s financial aid, or it would have been had it not closed its Bowater Mersey paper plant in 2012. The province had offered the firm a $25 million loan to keep the mill’s two paper machines operating and make efficiency upgrades, but Resolute never spent the money. In its NAFTA claim, Resolute said the amount on offer to PWCC for its Port Hawkesbury mill purchase was “unprecedented.” The province countered that many of the impugned measures related to new policies to better manage Crown lands and forestry resources.

Not out of the woods: Paper Excellence and the Canada-Indonesia CEPA

Though, thankfully, not all of these NAFTA forestry and paper related investor-state lawsuits succeeded, they give us a sense of the kinds of measures that can be challenged through ISDS and how inconsistently tribunals will rule on the same substantive matters—especially how broadly to interpret vaguely worded guarantees to a minimum standard of treatment or fair and equitable treatment. ISDS gives already litigious resource companies additional avenues for getting their way in policy.

One case in particular, AbitibiBowater v. Canada, set a dangerous precedent with respect to property rights on Crown lands that would be especially relevant in the event an investment treaty is reached with Indonesia or the Association of Southeast Asian Nations (ASEAN). That’s because a large and growing Canadian timber and pulp company would be in a very good position to use an eventual Canada-Indonesia CEPA to enhance its power over policy related to forestry, pulp and paper production, and exports.

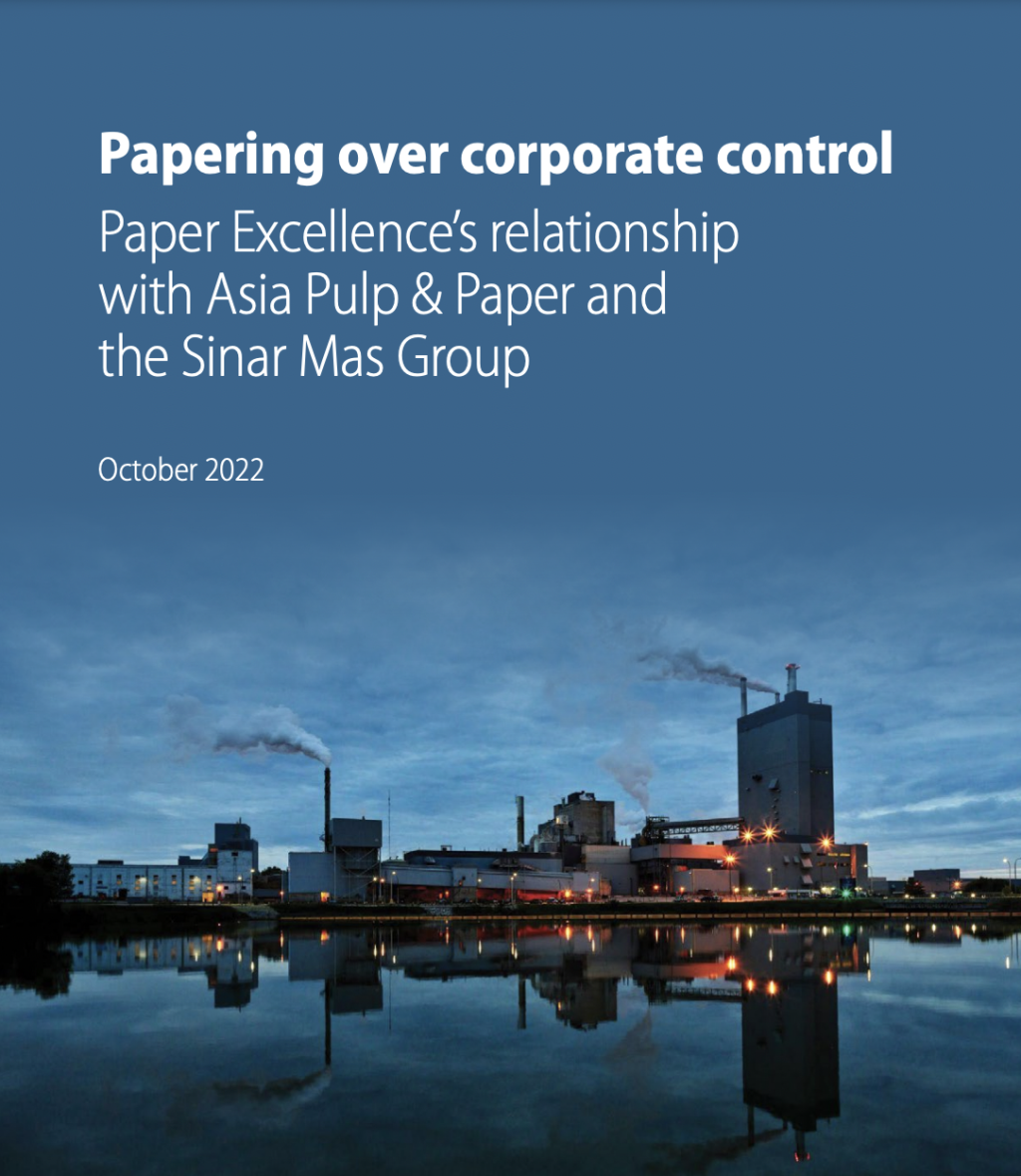

If you don’t work in any of these sectors, there’s a good chance you’ve never heard the name Paper Excellence. That is, unless you live in Nova Scotia, where a long-running legal dispute between the firm and the province over environmental standards is almost daily news. However, a recent report that definitively links Paper Excellence to Asia Pulp & Paper (APP) and the Sinar Mas Group should have us all questioning Canada’s eagerness to include ISDS in trade deals with Indonesia and ASEAN.

According to the report from Greenpeace Canada, Rainforest Action Network, Woods & Wayside, and Environmental Paper Network, “A nexus of factors such as family ties, overlapping management, and lobbyist filings indicate that Sinar Mas Group controls Paper Excellence. As such, Paper Excellence and APP can be considered as ‘sister companies’ under the common control of the Sinar Mas Group.” Paper Excellence does not dispute ownership links but continues to deny being controlled by APP or Sinar Mas, probably to avoid bad press.

APP is reported to have cleared two million hectares of rainforest in Indonesia for pulp and paper, “destroying critical habitat for orangutans, tigers, and elephants,” notes the Greenpeace report. Its peatland drainage practices “have been linked to catastrophic fires in 2015 and again in 2019,” and it has repeatedly come into conflict with farmers, land defenders and their communities. “This corporate group also had a record-breaking trail of debt problems beginning in 2001 that left banks and investment funds around the world—including the U.S. government—with substantial losses after protracted legal battles,” says the report.

APP, through Paper Excellence, has built a massive empire of mills in North America with which the company hopes to fuel paper production in Southeast Asia. Paper Excellence purchased its first pulp mill in Meadow Lake, Saskatchewan in 2007, and owned nine Canadian mills by the end of 2020. In 2021, it bought Domtar, one of North America’s largest pulp and paper makers—employing thousands of workers including at mills in Windsor, Dryden and Espanola, Ontario. Paper Excellence is now in the process of acquiring Domtar competitor Resolute, which has 40 facilities including pulp mills, sawmills and other wood product facilities, and hydro-electric plants.

Paper Excellence’s mills, with the exception of those owned by Domtar, are owned by holding companies incorporated in the Netherlands, Malaysia and the British Virgin Islands, according to the Greenpeace analysis. As the report lays out, this is a common practice to minimize the payment of taxes on revenues and to hide the ultimate beneficial ownership of the company.

While Canada does not have active ISDS treaties in place with any of these jurisdictions—Malaysia has only just ratified the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which includes ISDS—Paper Excellence’s ultimate Indonesian owners would be able to use a future Canada-Indonesia treaty to launch investor-state cases. Conservation measures, policies related to or affecting private electricity generation on leased Crown lands, or controls on the export of Canadian pulp could all potentially attract costly ISDS claims from APP or the Sinar Mas Group.

Canadian ISDS reforms fall short

Canada and Indonesia began negotiations toward the CEPA in March 2022. According to the federal government’s negotiating objectives, published in November 2021, Canada will seek to include in the agreement, “rules regarding the promotion and protection of investment and investors subject to a negative list of reservations, as well as transparent and predictable rules and disciplines relating to investor-state dispute settlement.”

From Global Affairs Canada briefings on these ongoing trade talks, we know that Canada has tabled its 2021 Model Foreign Investment Promotion and Protection Agreement (FIPA) as the preferred basis of an eventual investment chapter. Though Indonesia has expressed substantive and procedural concerns with ISDS, and recently terminated 23 bilateral investment treaties (BITs) following a 2014–16 review, the current government agreed to FIPA-comparable investment rules in its 2020 trade agreement with Australia and a 2021 bilateral investment treaty (BIT) with Singapore.

The inclusion of ISDS in the Canada-Indonesia CEPA would be an unfortunate case of selective memory in both countries. For Canada, it contradicts the government’s assertion, in 2018, that ISDS “elevates the rights of corporations over those of sovereign governments,” and that removing it from the renegotiated NAFTA (now CUSMA) enhanced the “right to regulate in the public interest, to protect public health and the environment.” For its part, the Indonesian government seems to believe allegedly more balanced ISDS treaty language will attract investment to the country while ruling out the kinds of high-cost cases that triggered the cancellation of dozens of Indonesian BITs in the last decade.

If you’re scratching your head wondering why Canada would exit ISDS with the United States due to concerns about policy space, yet jump into new investment treaties with ASEAN countries, the answer is simple: mining. Between 80% and 90% of Canadian investment in Indonesia in any given year relates to mining and fossil fuels. Canadian mining firms are regularly the top users of ISDS in Canadian investment treaties with lower and middle income countries (see graph above).

Including ISDS in Canada’s planned trade deals with Indonesia and ASEAN is designed to protect Canadian fossil fuel and mining firms and their financial backers from state and community opposition to potentially harmful projects or from sudden policy changes that affect future profitability. The trade-off will be granting those same rights to Indonesian investors in Canada’s forestry, pulp and related sectors.

Contrary to Canadian and Indonesian government assertions, the updated language in Canada’s Model FIPA and the investment chapter of the Indonesia-Australia FTA is not likely to significantly, if at all, enhance the right of governments to regulate to achieve environmental or other public objectives. The tribunal ruling in Eco Oro v. Colombia, involving a Canadian mining firm, offers a good example of the ineffectiveness of reformist language meant to protect policy space, since tribunals can, and frequently do, read new treaties like old ones, as Wolfgang Aslchner argues.

Canada’s Model FIPA and Indonesia’s recent investment treaties also do not adequately control for outrageous and growing awards for multinational corporations in ISDS proceedings. The recent $6 billion award against Pakistan in a mining dispute involving Canadian gold firm Barrick Gold would still be possible under investment treaty language favoured by Canada in the CEPA. In fact, the Canadian government is counting on it. Pakistan, rather than pay the award, negotiated with the mining firms to restart the controversial project.

Like other investment treaties signed by Canada and Indonesia, a CEPA with ISDS would supercharge the power and influence of multinational capital and weaken broader public interests in often contested areas such as mining, forestry, and fossil fuel development. The potential for costly lawsuits may discourage Canadian governments from taking necessary climate measures in the sector, such as protecting old growth forests and other natural carbon sinks. It would do so precisely when the climate emergency dictates that these activities must be much more closely managed or responsibly wound down and phased out. ISDS should be wound down and phased out too—just like it was in NAFTA.