Fast facts:

Proposed public asset sales in Newfoundland and Labrador could put the province’s future revenue-generating capacity at risk;

The proposed sale of the Newfoundland Labrador Liquor Corporation is likely to result in a net loss of provincial income within 5 to 18 years, depending on the sales price;

The proposed sale of the province’s ferry services would likely result in a monopoly, leading to service cuts and higher fares;

Selling off registration of motor vehicle and deeds services would reduce public oversight and transparency;

Privatizing the air ambulance service would increase government expenditure on health care; the private sector cost per patient would nearly double the public sector cost;

The province’s aging population, combined with a probable downturn in oil and gas revenue means the provincial government would face greater uncertainty about how to raise revenue to pay for needed public services in future;

The provincial government would be prudent to play the long game and walk away from proposed public asset sales.

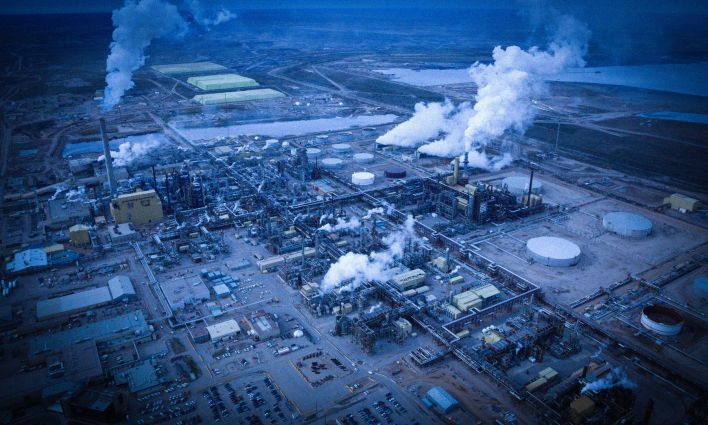

The Premier’s Economic Recovery Team (PERT) report in Newfoundland and Labrador describes the current fiscal situation as unsustainable and focuses heavily on the size of the provincial debt. To tackle the debt, the report proposes drastic cuts to the province’s public services, including the Newfoundland Labrador Liquor Corporation (NLC), the ferry service, motor vehicle registration, and registration of deeds.

However, the proposed asset sales do not place enough value on the province’s economic future. Alternative proposals, such as the People’s Recovery paper, outline a vision which does not rely on austerity measures and privatization.

In the 2021-22 budget, the provincial government anticipates that the NLC, vehicle and driver licence registration, the registry of deeds, companies and securities, and the intra-provincial ferry system are estimated to generate $210 million, $93 million, $31.1 million and $8.16 million in revenue, respectively. If the government were to privatize these four services, they would forgo $342.3 million in revenue, equivalent to 65.3% of non-tax provincial revenue. Without the revenue from the assets, the province will depend more heavily on the remaining income sources, notably personal income taxes, sales taxes and offshore royalties, which currently generate $5 billion of the total estimated provincial revenue of $5.5 billion.

In addition, the provincial deficit is showing signs of a reduction as highlighted by the major revisions that happened in the latest fall update of the provincial budget. The update shows that net debt is projected to be $500 million lower than the original Budget 2021 prediction. The projected deficit for 2021-22 was revised to be $595 million, $231 million lower than the initial forecast. By 2025-26, the expected budget deficit is $88 million, and given the promising update for the 2021-22 fiscal year, the province may see a surplus sooner than anticipated.

We examine each of these five services in turn.

Newfoundland Labrador Liquor Corporation (NLC)

The NLC is a self-financing agency. The gains from privatizing the NLC depend on how short-term outcomes are weighed against long-term outcomes. In the short-term, selling the NLC would allow the provincial government to pay off a percentage of the debt, reduce spending on interest payments, and continue generating a fraction of the initial revenue through taxation. As a result, the PERT report recommends selling all or a majority of the interest in the NLC and reviewing how alcohol is taxed provincially.

The most important factor to consider is that the sale price of the NLC remains unknown. In an interview with Ben Murphy, co-host of the 590VOCM Morning Show, senior investment advisor Larry Short suggests that the selling price might be $2 billion if a buyer is willing to buy the company to earn 10% per year on their initial investment, assuming the NLC continues to earn roughly $200 million. He recognizes that the valuation could be higher or lower, suggests numbers that range from $1.3 billion to $3 billion, and confirms that the government’s final choice should be contingent on securing a high selling price.

However, a report from the Government of Canada places the gross profit margin for liquor stores at 25%, which could put the likely sale price of the NLC closer to $800 million. This difference in valuation results in $1.2 billion less in immediate cash influx and reduces savings on annual interest payments by $24 million, as opposed to $60 million.

From a public health perspective, the provincial government will still bear the cost of alcohol-related education, harm reduction, medical and enforcement costs—only without being able to directly control its distribution, marketing, and product selection. In addition, employees working in Newfoundland and Labrador’s public sector are unionized and, on average, earn higher wages, have better non-wage compensation and work in safer and fairer workplaces compared to non-unionized retail workers in the private sector. Drawing lessons from the COVID-19 pandemic is crucial here, as the last two years have shown the ways in which safe and stable employment acts as a preventative health care measure and can reduce strain on other government services, notably the health care system.

In the short term, privatizing the NLC would mean a reduction in $210 million in secure annual revenue for the provincial government. The long-term impacts depend on the sales price, but the provincial government can likely anticipate a net revenue loss within 5 to 18 years.

The ferry service

The province’s ferries are a critical service. Annually, the province’s total marine operations transport roughly 800,000 passengers, 400,000 vehicles, and 13,000 tonnes of freight. A portion of the provincial ferry service is already privatized, yet this change has not led to improvements in service delivery. A 2021 report from Newfoundland and Labrador's auditor general on the province’s mismanagement of the procurement of two new vessels recommends additional oversight and cooperation between government departments to address existing issues.

The findings from the report fuelled calls to privatize the remainder of the service, yet any efficiencies from privatization would be undercut by the creation of a privately owned monopoly for ferry services. Since the number of travellers on Newfoundland and Labrador’s ferries is small, it’s very unlikely that more than one company will offer trips on the same routes. This situation is known as a “natural monopoly”, meaning that we expect that only one business will provide the service.

When monopolies are controlled by businesses, the public loses because the business is able to gouge them with higher prices and poorer quality of service. In the case of the province’s ferry service, travellers who depend on the ferry would have no other option but to pay these higher prices because there are no other ferry trip providers on the routes. If the province’s ferries are sold to a private company, people in the province can expect to see cuts to the south coast ferries and/or price increases as the new company makes changes to turn a profit.

When it comes to natural monopolies, the government has a critical role to play in ensuring that citizens have access to the services they need. Keeping this service under public control ensures that the ferry service is not used by private interests to gouge travelers.

Registration of motor vehicle and deeds

The potential privatization of motor vehicle registration and deeds is of concern, due to the importance of quality control for these services. When the private sector profits off of a service where the public assumes all the risk, privatization often has negative consequences. Registration services provide secure and steady revenue for the province and allow the province to retain oversight and transparency over the registration process.

A 2016 report commissioned by Alberta Transportation on the privatized provincial driver examination model concluded that Alberta had the highest road testing fees in all of Canada, stakeholder groups generally distrusted the model, and that the provincial government only provided limited oversight. Furthermore, complaints of false documents being issued, bribes and fraud, and sexual harassment by private contractors serve as a cautionary tale.

The Air Ambulance Service

Currently, the provincial government owns, maintains and dispatches two air ambulances and contracts two additional air ambulances from private sector operators to use as needed. Health care is not a profit-maximizing industry, therefore shifting the provision to a private provider that operates under a profit motive is likely to undermine the quality of the service. Shifting away from government-owned and operated air ambulances would have immediate negative consequences and result either in increased government expenditure or reduced service capacity. Data from Newfoundland and Labrador from 2019-20 and 2020-21 finds that the average private sector cost, per patient, was nearly double the cost, per patient, in the public sector. The private sector cost, per patient, is substantially higher since it includes the monthly retainer that private contractors are paid to provide their services. Expanding the public sector air ambulance service to eliminate the need to rely on private sector aircrafts and pilots would be cost-effective and would not jeopardize the quality of the service.

Newfoundland and Labrador’s economic future

While the PERT report focuses on the role of debt, its true importance is still debated within economic literature. Government spending does not need to be seen as cause for concern, as the alternative is for households to bear those costs themselves. Government debt should not be the primary focus so long as governments hold revenue generating assets as adequate collateral.

In addition, if the air ambulance and ferry service were to be entirely privatized, the services would remain subsidized by government to ensure that all Newfoundlanders and Labradorians can receive essential medical care and access transportation. The requirement for ongoing public subsidies highlights that there is in fact no “market” for some services, and privatization will result in higher government expenses while private investors profit. The consideration of the long-term uncertainty surrounding provincial revenue streams has been missing in this conversation. The aging population of Newfoundland and Labrador and the future of oil and gas prices and capacity for exploration mean that the province’s tax base contains many uncertainties. Selling off secure assets that are guaranteed income streams only serves to increase those uncertainties and with increasing uncertainty comes volatility—a potential deterrent to economic growth and development.

Rather, the provincial government would be prudent to prioritize keeping essential services public in order to ensure that they maintain control over quality and service delivery. Putting Newfoundlanders and Labradorians first means ensuring that transportation is affordable and accessible, quality control is consistent for deed and motor vehicle registration, workers’ rights and labour conditions are prioritized, and the economic future of the province is not compromised for short-term gains.