In an August 2021 report, the Intergovernmental Panel on Climate Change concluded the Paris Agreement climate targets could soon be out of reach without immediate and massive greenhouse gas emission reductions this decade. António Guterres, the UN Secretary General, warned the report “is a code red for humanity.”

The climate crisis and unprecedented wealth inequality are usually portrayed as separate issues. Even as extreme weather events are mounting, so, too, are the extremes of neoliberal inspired inequality—worsening during the pandemic. They are in fact joined at the hip.

The wealthiest 1% of individuals worldwide has emitted 100 times as much CO2 per year as the bottom 50%. According to research by Thomas Piketty and Lucas Chancel, the richest 10% of individual emitters contributed to 45% of global emissions. The poorest 50% of the world’s population accounted for 13% of world emissions.

The world’s billionaires have seen their wealth surge by over $5.5 trillion since the beginning of the pandemic—a two-thirds jump.

The international climate-inequality relationship is brought into stark relief when comparing Canada, one of the world’s richest countries, and Mali, one of the world’s poorest countries that has already been devastated by climate change. Mali ranked near the bottom, 184th on the latest UN Human Development Index. Canada ranked 16th. Mali’s annual carbon emissions per capita were 0.2 tonnes. Canada’s annual per capita carbon emissions were 15.3 tonnes. According to the Ecological Footprint Index, Mali ranked third lowest. Canada’s UN ecological footprint ranked 170 from the bottom.

Annual per capita carbon emissions for the top 1% Canadians was about 35 times the world average, placing Canada fifth in the carbon emitter rankings. The number of Canadian billionaires has more than quadrupled in the past two decades, and their combined wealth has increased fivefold. Canada’s billionaires now have as much wealth as the 12 million poorest Canadians.

The federal government record on reducing climate change and inequality

Canada’s climate emissions have risen by 26% since the 1997 Kyoto Protocol. During the past six years, Canada’s emissions have continued to rise, interrupted only by a short-lived drop during in the first year of the pandemic.

Based on government projections, University of Waterloo academics Angela Carter and Truzar Dordi have calculated that fossil fuel production in Canada is scheduled to rise until 2039 and remain above current levels in 2050. They conclude that Canada, with 0.5% of the world’s population, would exhaust 16% of the world’s remaining carbon budget to maintain emissions below 1.5C.

Canada provides more public finance to the fossil fuel sector, per capita, than any other G20 country. Canadian financial institutions continue to lend massive amounts of money to the fossil fuel sector.

A report by the research firm Profundo found Canadian banks have financed fossil fuel companies nearly $700 billion since the Paris Agreement was signed. Meanwhile, Canada’s two largest public pension funds, the Canada Pension Plan and the Caisse de dépôt et placement du Québec, are also heavily invested in fossil fuels.

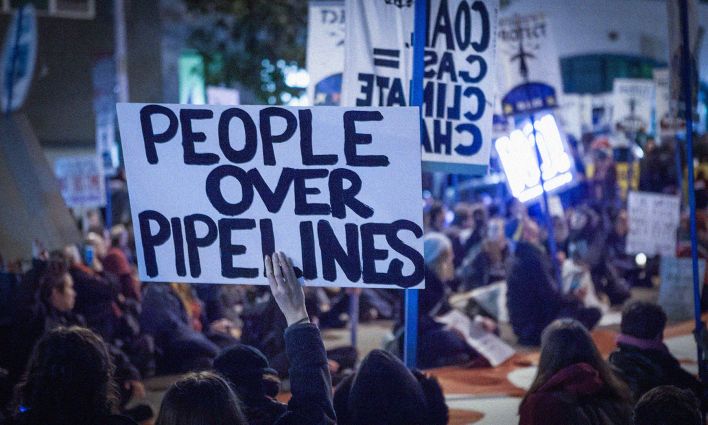

While the federal government implemented a tax on carbon pollution, this is more than negated by its financing of a publicly owned corporation to build a pipeline for Alberta’s rising oilsands production.

Nor has the government reigned in subsidies to the fossil fuels sector.

Its investment in questionable carbon offsets and carbon capture and storage that lock in fossil fuel production, do not inspire confidence that Canada will meet its net zero climate targets.

Canada’s latest commitment to lower emissions 40-45% below 2005 levels is still not on target to reach this commitment and is actually a weaker pledge than what the IPCC called for.

Reversing post-war achievements on inequality

Post-war achievements in reducing inequality were reversed after 1980. Financialization, the return of what Keynes called the oppressive speculative power of "functionalist financial investors”, drove up wealth inequality.

The capital market became a gigantic casino boosting the returns of the wealthy while producing economic instability and income stagnation for the majority. The top marginal income tax rate and corporate income taxes were cut by more than half. Taxes on capital gains were slashed and regulatory loopholes facilitated tax avoidance and evasion via an archipelago of tax havens.

The 2019 Speech from the Throne stated: “Government will also identify additional ways to tax extreme wealth inequality, including by concluding work to limit the stock option deduction for wealthy individuals at large, established corporations, and addressing corporate tax avoidance by digital giants.”

One of the most contestable things said about that speech was by John Manley—former CEO of the big business lobby organization, the Business Council Canada, and former deputy leader under the Chrétien government—in an interview with BNN Bloomberg: "There aren't enough rich people, and secondly, if you tax them enough, they'll leave Canada.”

Consider this in the context of government inaction on reducing wealth inequality: no wealth tax on the super rich, no increase in the top income tax bracket, no corporate income tax increase, no increase in the capital gains and dividends tax, no surtax on Canadian billionaires profiteering from the pandemic, no clamping down on tax avoidance and evasion.

According to the Canada Revenue Agency, some $3 billion of annual tax revenue is lost from the untaxed investment income that is generated from the $240.5 billion that wealthy Canadians have squirrelled away in offshore tax shelters.

The lack of an estate tax has allowed Canada’s wealthiest family dynasties to pass down exorbitant amounts of wealth to younger generations. Without such a tax, the transfer of wealth by the baby boomer generation to their children will accelerate this upward trajectory.

CCPA Senior Economist David Macdonald recommends a 45% estate tax on estates in excess of $5 million, which would add over $2 billion to federal revenue.

Macdonald also proposes eliminating the 50% tax break for capital gains and the 25% tax rate on dividends, which would, respectively, raise $11 billion and $5 billion annually, almost exclusively targeting Canada’s richest. A solid majority of Canadians support such taxes on the wealthy to reduce inequality and to help strengthen the social safety net.

A majority of the Canadians is also on board with decisive action on climate change, According to a 2019 Abacus Survey, commissioned by Seth Klein for A Good War, when ambitious climate action is linked to tackling inequality, support dramatically goes up. The survey found, in part: if the government would increase taxes on the wealthy and corporations to help pay for the transition to net carbon zero, 78% of respondents became more supportive of a bold climate plan.

Transformation or continued slide toward the abyss

Picketty identifies an important lesson from history: that the level of social inequality across societies primarily depends on major social and political mobilization and ideological change.

“Things can change much faster than the dominant discourse and the various elites in different societies tend to imagine,” Picketty writes.

Such a transformation occurred after World War II, though many of those gains have been rolled back over the last four decades.

“Historically, pandemics have forced humans to break with the past and imagine their world anew,” writes novelist Arundhati Roy. Is the coronavirus pandemic a prelude to transformative change? Will this federal election open a crack that lets the light in?

Archaeologist Joseph Tainter’s examination of past civilizations in The Collapse of Complex Societies, identifies extreme concentration of wealth as a major reason for their collapse.

Will the plutocracy be caught in a “progress trap”, described by Ronald Wright in A Short History of Progress , unwilling to relax its hold on power and privilege?

Or will government—under pressure from widespread citizen mobilization and the ongoing paradigm shift away from neoliberal orthodoxy—step up to forestall a climate catastrophe, “and lay the foundations for a better world?”

In the words of Bob Dylan: “It’s not dark yet, but it’s getting there.”