Housing and affordability top every public opinion poll as the most pressing issues impacting people’s lives today. The federal government has struggled to respond—introducing a series of modest measures over the past two years that have helped, but not contained, skyrocketing costs for housing and the basics. Four years after the first wave of the pandemic and marginalized women and their families are still scrabbling to get by day to day.

On Tuesday, Statistics Canada released the monthly CPI figures, once again confirming that housing is the number one driver of inflation today. Yet, the chorus from Bay Street continues to call for government to aggressively scale back social spending, the same group along with right-wing politicians still peddling the discredited narrative that government programs are driving up inflation and hurting working people and households.

Despite former Bank of Canada governor David Dodge lighting his hair on fire the day before the budget, the sky has not fallen—but the government’s budget has generated a substantial backlash from the business community, the same business community the government has continued to favour in programs and policy choices.

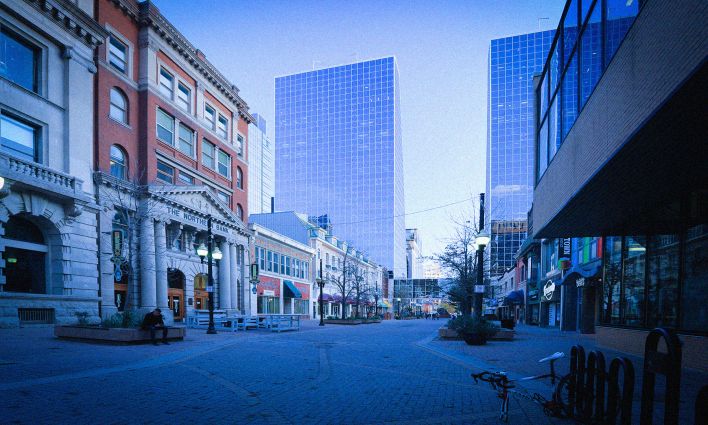

Getting out in front of the housing crisis

Tuesday’s budget was a massive attempt on the part of the government to take back control of the political narrative. Titled “Fairness for every generation,” its centerpiece was a new Canada Housing Plan that finally acknowledged the critical role of social housing—and the desperate plight of renters.

The plan includes $1 billion for the Affordable Housing Fund, a new $1.5 billion Canada Rental Protection Fund which will make available $1 billion in loans and nearly $500 million to construct non-profit housing projects, $1.3 billion over four years for Canada’s Homelessness Strategy, and a national renters’ bill of rights.

This package could have made a huge difference if it had been introduced back in 2017, but it’s great to see funding now directed to social housing, the result of the diligent efforts of housing advocates and practitioners across the country. What’s needed now is meaningful engagement, consultation, and input from marginalized communities, community advocates, and voices from the non-market housing sector. And establishing affordability targets and robust accountability mechanisms to see it through.

Wins for the women’s movement

There were other important gains as well. New funding for youth mental health ($500 million over five years) and school food programs ($1 billion over five years) will enhance the capacity of community-based service providers to meet pressing needs. A new $1 billion child care expansion loan program, and grants to support low-fee public and nonprofit child care spaces will help build the promised child care system.

The government also announced its intention to create a new Sectoral Table on the Care Economy to develop recommendations for strengthening Canada’s social infrastructure. Canada’s labour movement has long fought for such a table. Admittedly, there’s no budget attached to this proposal but this is a promise to engage with the sector to elevate paid and unpaid care work and to explore solutions to improve the punishing working conditions and low wages confronting care workers.

Budget 2024 allocates $1.5 billion over five years for the roll-out of the first phase of a universal pharmacare plan that will include access to free contraception and diabetes medications for millions of Canadians.

It is hard to overstate how fundamental free birth control is to women’s bodily autonomy and gender equality. With this announcement, the federal government has moved to fill a critical gap in our public health care system and uphold the right of women to choose if and when to have children through contraception of their choice—regardless of who they are, where they live, their age or disability status, or their income.

There are lots of questions still to answer about the pharmacare plan itself—the details of which will be worked out with the provinces and territories. The bluster and dramatics have, unfortunately, already started with Alberta signaling that it won’t participate. But British Columbians certainly know a good deal when they see it. B.C. was the first to bring in free birth control last spring and since that time, more than 188,000 people have received free contraceptives.

This year’s list of half-steps and missed opportunities

As in year’s past, there were lots of half-steps and missed opportunities too.

With the wind-down of pandemic support, gender equality organizations turned out in large numbers at the Finance Committee hearings last year to push for stable and predictable funding for the sector, including those working to address gender-based violence and to support the 2SLGBTQI+ community.

The budget funded some important projects: $1.3 million over three years toward a regional Red Dress Alert System to notify the public when an Indigenous woman, girl or two-spirit person goes missing, $30.6 million over three years for legal advisory and education services for victims of workplace sexual harassment, and $12 million over five years to fund projects aimed at combatting hate against the 2SLGBTQI+ community.

But there were no additional funds for Canada’s National Action Plan to end Gender-Based Violence or the over-subscribed Women and Children’s Shelter and Transitional Housing Initiative. Or the Women’s Program at WAGE Canada.

Another missed opportunity this year was the funding attached to the new Canada Disability Benefit (CDB). Legislation establishing the CDB passed unanimously last year. Negotiations have been going on behind the scenes with different stakeholders on the specific details.

Budget 2024 sets out the broad parameters: The benefit will be initially set at $2,400 per year (or $200 per month) for low-income people with disabilities aged 18 to 64 years and will start in July 2025. The frequency of payment, income thresholds, method of indexation, phase out rates, and application and appeal processes are yet to be worked out.

Only those with a Disability Tax Credit certificate will be eligible—an estimated 600,000 people. This is an increase of 108,000 over the current number of working-age people (in all income groups) claiming the DTC, but falls well short of the almost one million working-age people with disabilities who live in low income. It is going to be a difficult and costly process to make sure that people sign up for the DTC—if they are eligible at all. The DTC is notoriously difficult to access. Many will fall through the cracks.

The budget ‘aspires’ to see the combined amount of federal and provincial or territorial disability supports grow to the level of Old Age Security (OAS) and the Guaranteed Income Supplement (GIS)—about $20,000 per year. We’re clearly a good distance away from this. In Ontario, ODSP recipients receive $15,600 per year—and there’s no guarantee at this point that the provinces and territories won’t claw CDB back from recipients.

A federal-provincial game of chicken is being played out here—the federal government not willing to fully step into the space, the provinces will be looking to cut costs on the backs of the most vulnerable. So it’s wonderful to have a Canada Disability Benefit finally in place, but this barebones version doesn’t begin to address egregious levels of poverty that define people’s lives. Needless to say, the disability community is hugely disappointed and so should we all be.

What will the Liberal legacy be?

There’s a pattern here, budget to budget. One or two notable spending initiatives and a smattering of smaller projects nodding to different constituencies. From climate to housing to poverty reduction—or even investments in research and innovation, the government has extreme difficulty in sustaining focus on the files that matter.

The disconnect between stated policy goals and program outcomes speaks not only to the notable difficulties of working collaboratively within Canada’s federal political system but also to the political and economic constraints inherent in the pursuit of equality and social justice within a neoliberal governing framework. The government queues up an important investment only to hand off responsibility for delivering on policy goals to the private sector—as we saw in Budget 2023 with its green economy package.

The new housing plan is another case in point. Even as the government made historic new investments in social housing, it allocated ten times the amount to top up the Construction Loans Program for private developers to $55 billion—a fund that has only dispensed $18 billion since its launch in 2017, producing apartments available at rents that overwhelmingly exceed affordability targets.

For gender equality organizations, labour unions and other social justice groups it’s been a frustrating exercise. Critical issues are acknowledged and selected initiatives are funded, but the programs, as designed and delivered, are never enough to spur needed systemic change. Year after year, repeat. The upshot: growing despair and struggle among the most vulnerable in Canada—and growing criticism of the government and its ability to deliver on crucial policy goals.

For example, the Trudeau government’s narrow approach to feminist government, focused on the middle class and notions of prosperity and leadership, has resulted in only modest gains for marginalized women and gender diverse people. Stated another way, it has provided “a foothold for some”, but it has not provided the leverage, or resources needed, for a more transformational approach to gender-based violence, the division of caring labour, or access to economic security.

Time and again over the last eight years, the Trudeau government grabs for low-hanging fruit, then subsequently spins proposed programs to the public as bold, progressive policy choices.

A surprise move and the fight to come

The one surprise move in Budget 2024 was the decision to increase the inclusion rate on capital gains realized annually above $250,000 by individuals—and on all capital gains realized by corporations and trusts—from one-half to two-thirds. The CCPA has been calling on the government to address this stark inequity in the tax code for decades. This measure is expected to raise $20 billion over the next five years and will be paid by the wealthiest 0.13 per cent (or 40,000 people) at the very top of the income ladder and approximately 12 per cent of Canada’s corporations.

Of course, the capital gains inclusion rate used to be at—or above—the proposed 66.6 per cent between 1988 to 2000. But, as my colleague David Macdonald says, “if this is the government’s response to spending concerns, let’s bring it on. It’s about time we look at Canada’s revenue problem.”

It’s a question of fairness. A dollar is a dollar is a dollar. Why should a high-income individual pay a lower tax rate on capital gains income than a senior living off the interest income of her GICs or a cleaner working multiple jobs to make ends meet. The wealthy should pay their fair share.

Of course, Bay Street is pushing back, arguing that this move will reduce needed investment in productivity and economic growth—a statement that is demonstrably not true. Misinformation is making the rounds on social media and in legacy broadsheets.

It is interesting that the federal government gambled that the smart money on Bay Street would see the bigger picture—and the mountains of cash flowing to business in the forms of new investments in the green economy, housing, transportation and so on. That they would appreciate the need for a meaningful intervention to generate increased revenues having foregone the opportunity to impose windfall profit taxes on the oil and gas sector and grocery monopolies.

With Budget 2024, the government is trying to position itself for the difficult year ahead. In truth, I don’t think that social justice issues will figure prominently in the fight to frame next year’s ballot box question. It is much more likely that issues such as free birth control will be used (as in the past) as wedge issues to mobilize partisan support. But the political climate does suggest an opening for progressives to get moving with substantive recommendations for Budget 2025.

If the government is going to stir up Bay Street, best to make it count. A program of austerity and half measures will only serve to exacerbate inequality, derail the climate fight and impose suffering on the most vulnerable. It is this inequality that engenders a collective sense of despair and powerlessness, that erodes trust in all institutions, that drives the wedge further between the young and the old, renters and homeowners, marginalized communities and the wealthy.