For 24 years, the Canadian Centre for Policy Alternatives (CCPA) has been publishing our annual Alternative Federal Budget (AFB).

The AFB is an exercise in imagination. Our purpose is to expand the collective imagination of what is possible, to instill hope in hard times, and to make crystal clear alternatives to the status quo. And these alternatives aren’t just imagined. They are clearly articulated. We’ve put a price tag on them. And we’ve found realistic ways to pay for them.

Every government budget tells you about that government’s priorities, about what matters to them. What matters to the AFB?

Accessible public health care matters

At a time when Canada’s cherished public health system is under unbearable stress and strain, what matters to the AFB is strengthening our public health care system and investing in the root causes of illness—to prevent more people from needing medical care.

The AFB will ensure that health care dollars are not spent on private, for-profit clinics, which put Canadians at risk of user fees and extra billing.

The AFB will provide targeted federal funding to retain nurses, doctors, and other health care workers.

The AFB will establish a National Care Economy Commission.

The AFB will remove the income restrictions from the Canada Dental Benefit to make it a universal benefit.

The AFB will move forward with the Canada Pharmacare Act, to provide free coverage for prescribed medicines to everyone in Canada.

The AFB will establish the Canada Mental Health Transfer at $5.3 billion annually over five years. The AFB will also invest $5.7 billion to support an additional 82 million hours of home care for the nearly 90,000 Canadians waiting to access these services.

And the AFB will do so much more, including an entire plan to put health equity at the heart of the system.

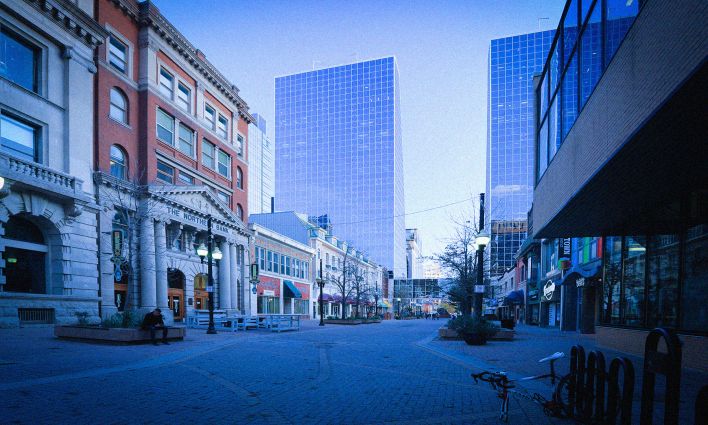

Affordable housing matters

The housing market has gone through the roof and even average rents are beyond too many Canadians’ ability to pay—and so what matters to the AFB is that everyone in Canada can find an affordable place to live.

Federal, provincial and municipal governments have looked the other way for far too long. As the authors in our Affordable Housing and Homelessness chapter write: “This housing crisis has been brewing for decades. Fixing it will require major new public investments for a generation.”

The AFB will accelerate the rollout of the Federal Lands Initiative of the National Housing Strategy, which has done little to put federal land into use for affordable housing.

The AFB will build one million new non-market and co-op housing units over the next decade.

The AFB will also support the community housing sector to acquire existing affordable rental buildings to bring them into the non-profit world.

The AFB addresses the intersection between homelessness, mental health, and addiction. And it does so much more to fix the lack of affordable housing options for generations to come.

Access to $10-a-day child care matters

While the federal government has rolled out a plan to reduce child care fees to $10 a day, far too many families in Canada live in a neighbourhood that simply doesn’t have enough spaces.

What matters to the AFB is that we expand the number of publicly funded, publicly managed child care spaces—and adequately pay the staff required to service those spaces—in order to ensure that everyone can access affordable, quality child care.

Food security matters

In a year in which food prices skyrocketed as grocery chain stores rolled in excess profits, what matters to the AFB is that we reduce overall food insecurity by 50 per cent and reduce severe food insecurity by 33 per cent by 2026.

What matters to the AFB is that we “strategically focus on addressing the interlocked emerging crises that threaten our agriculture and food system”—because accelerating climate change, Russia’s war in Ukraine, global supply chain disruptions, and price hikes at grocery chains threaten our ability to ensure nutritious, affordable food is on every household’s table.

The AFB will remove corporate lobbyists from the policy-making process— they’re rigging the game.

The AFB will take measures to increase the market share of small- and medium-sized retailers selling local, regional, and domestic agricultural products.

The AFB will establish a climate change-focused agriculture extension institution. Reducing agricultural emissions is one of our most complex tasks in reducing greenhouse gas emissions.

And the AFB will establish the Foodshed Lands Trust, which will permanently remove agricultural land from private markets and enable local farmers to produce for local markets in their “foodshed.”

Poverty reduction matters

The advent of the Canada Emergency Response Benefit (CERB) during the early days of the pandemic led to a reduction of poverty in Canada, but now that CERB no longer exists, poverty is back on the rise. What matters to the AFB is a plan to end poverty. The AFB will immediately retire the CERB and CRB debt and immediately cease pursuing anyone living near or below the low-income measure for repayments.

The AFB will initiate a non-taxable Canada Child Benefit End of Poverty Supplement (CCB-EndPov). The CCB-EndPov would provide an additional $8,500 per year to eligible families with an earned income of less than $19,000 for the first child. The benefit would provide additional amounts for multiple children and the supplement would reduce at a rate of $0.50 for every additional dollar of income.

This supplement would reduce child poverty from eight per cent in 2023 to 3.6 per cent, according to the Market Basket Measure. Single-parent families, who are mostly women-led and who have extremely high rates of poverty, would see their child poverty rate reduced from 24.3 per cent to 8.4 per cent.

The AFB will cancel the 10 per cent increase to Old Age Security (OAS) payments for those 75 years and older, redirecting those funds to lower the age of eligibility for the Guaranteed Income Supplement (GIS) to 60 in order to address seniors’ poverty for those aged 60-65.

The AFB would create a new Canada Livable Income. This new program would be available to adults aged 18-64 who cannot access other pillars and who are not students. It would target those living in deep poverty by providing up to $19,000 for individuals or $11,000 for couples.

The AFB will design and implement the Canada Disability Benefit, which would be accessible to those aged 18 to 64 who are not receiving one of the other three federal income support pillars who are living with disabilities. The benefit will provide $11,040 per year and would be received in addition to provincial and territorial disability assistance programs. The CDB would fully phase out at $37,000 in employment income.

The AFB measures would lift 369,000 children out of poverty, reduce deep poverty by 33,000 people, lift 84,000 older Canadians out of poverty, and the AFB’s Canada Disability Benefit would lift 647,000 Canadians out of poverty.

Decent work matters

What matters to the AFB is that every worker can access decent work. That means clamping down on business models that rely on precarious work and raising wage standards, because workers’ pay isn’t keeping pace with rampant inflation. It means providing access to training opportunities that could position workers for better jobs.

The AFB will follow through on promised Canada Labour Code amendments and immediately bring into force amendments to Part III, which establish equal treatment and compensation for employees, including those in precarious work. It will also invest in needed enforcement to contend with the misclassification of workers as self-employed and the exploitation of vulnerable workers in their workplace.

This includes a strategy for care workers: the AFB will provide for an in-depth, comprehensive, Canada wide workforce strategy to address the current recruitment and retention crisis, so that qualified personal support workers, nurses, occupational and recreational therapists, dieticians, and other workers who contribute to seniors’ care can staff existing and new facilities and services in the community. And so much more.

The climate crisis matters

What matters to the AFB is that Canada treats climate change like the red-hot emergency that it is.

The AFB will place an immediate moratorium on new fossil fuel extraction and exploration projects and implement a regulatory phase out of oil, natural gas, and coal production for fuel by 2040.

Furthermore, the AFB will eliminate all federal subsidies and financial support to the fossil fuel industry by the end of 2024.

The AFB makes several major investments to decarbonize key sectors of the Canadian economy, promoting biodiversity and ecosystem recovery, enacting a comprehensive strategy for a green and just transition for Canada’s industrial sectors.

The AFB will also attach climate-related conditions to funding opportunities available across federal departments, as well as labour and equity conditions, where applicable. And that’s just for starters.

Decolonization matters

After more than 150 years of colonialism, what matters to the AFB is that Indigenous Peoples are supported in their efforts to rebuild their unique languages, laws, cultures, governments, and economies.

The AFB will invest $77.29 billion over five years to meet base community infrastructure needs, including buildings, ports and wharfs, transportation infrastructure, all-season road access, utilities infrastructure, and connectivity infrastructure.

The AFB will invest $101.84 billion over five years to meet decades of neglected housing needs to address overcrowding, on-reserve migration, unit replacement, new lot servicing, repair needs, and population growth. And the AFB will do much, much more.

Gender equality matters

The pandemic has wreaked havoc on many women’s personal and work lives. What matters to the AFB is that women and gender-diverse people join in a just recovery.

The AFB will allocate $20 million over the next three years for the development of a new employment equity regime, aligned with the efforts of the Office of the Pay Equity Commissioner and the Office of the Accessibility Commissioner.

The AFB will establish a public, universal, single-payer pharmacare plan with a national formulary that includes the full range of sexual and reproductive medicines, commodities, and devices for all.

And the AFB will do much more to ensure the health and well-being of women and gender-diverse people.

An inclusive society matters

What matters to the AFB is that everyone is welcome in Canada—we can build an inclusive, equitable society.

The AFB will amend the definition of harassment and violence in Part II of the Canada Labour Code to include racism as a form of workplace violence and harassment.

The AFB will create legislation to address online and other forms of hate to counter the growing number of hate incidents in Canada.

The AFB will create an Anti Racism Act that will name and address all forms of systemic racism and hate. This will give a legislative foundation to an independent Anti-Racism Secretariat that reports directly to parliament and has its own budget.

The AFB will give permanent resident status for all migrant workers, on arrival, and introduce a comprehensive, inclusive and ongoing immigration status regularization program for all those without status in Canada.

The AFB will remove the minimum necessary income criteria for the parent and grandparent sponsorship program; it will remove the numbers cap and end the lottery system.

The AFB will increase family-class immigration to 35 per cent of total annual immigration and increase annual targets and intake for refugees and protected persons.

The AFB will increase processing resources to reduce, then end the immigration and refugee backlog.

Affordable post-secondary education matters

What matters to the AFB is that Canada leads the way in making postsecondary education and lifelong learning a core part of our culture—it’s good for people and for the economy.

The AFB will provide transparent, predictable, and adequate federal cash funding to the provinces and territories in support of public post-secondary education through an $8 billion a year National Post-Secondary Education Transfer, discrete from the Canada Social Transfer, with conditions. It will sign agreements to ensure that the federal funding is in addition to provincial spending for the sector and is used to lower tuition for all students, invest in workforce renewal, and improve access to underserved communities.

The AFB will increase and make permanent the pandemic student grant level of $6,000 and make permanent the larger loan limit. It will also ensure more equitable disbursement, moving toward a 50:50 ratio for the grants and loans model.

The AFB will allocate an additional $500 million a year to expand access to apprenticeships and other forms of skills training. This allocation will build upon existing programs and improve access to these supports.

Fair and progressive taxation matters

The AFB will tax extreme wealth by introducing a progressive wealth tax—beginning on net worth over $10 million—which would bring in $32 billion in the first year and $409 billion over 10 years. This tax, which could be paid by fewer than 0.5 per cent of Canada’s richest families, would increase federal tax revenue by almost 10 per cent.

The AFB will restore the corporate income tax rate, boosting the federal rate to 20 per cent, from its present rate of 15 per cent, which would generate more than $11 billion annually.

The AFB will raise the inclusion rate for capital gains to 75 per cent, which would bring in more than $9.5 billion.

The AFB will cap corporate pay deductions at $1 million in total compensation for every employee. Corporate executive salaries hit a new record in 2021.

The AFB will limit the dividend tax credit, saving the federal government at least $1 billion annually.

The AFB will implement a windfall profits tax. Canadian corporations made record-high profit margins in 2021. Margins remained elevated throughout 2022. A tax on profits greater than 120 per cent of pre-pandemic margins could, conservatively, bring in well over $20 billion for 2021 and 2022.

The AFB will end the Real Estate Investment Trusts (REIT) tax break for housing. REITs have gained control over a large segment of Canada’s rental housing and tactics to drive out existing renters in order to make more revenue. REITs do not have to pay any corporate income tax. If REITs were taxed like other Canadian corporations, they would pay about $130 million in annual corporate income tax.

All told, AFB 2024 proves that Canadians really can have nice things—if we make our tax system more progressive and make smart investments in public services, income supports, social and physical infrastructure.