In January, the U.S. handed Canada a golden opportunity to end TC Energy’s flagrantly climate-denying $15-billion NAFTA lawsuit against the Biden administration’s decision to cancel the Keystone XL pipeline expansion. All Canada has to do is agree with the U.S. that the company’s investor-state case is moot and poof—all done. Maybe.

This takes a bit of unpacking. Some background on the pipeline proposal, opposition to Keystone XL, the renegotiation of NAFTA, and the state of the Canadian company’s trade lawsuit is in order.

Our content is fiercely open source and we never paywall our website. The support of our community makes this possible.

Make a donation of $35 or more and receive The Monitor magazine for one full year and a donation receipt for the full amount of your gift.

Finally getting serious about climate change

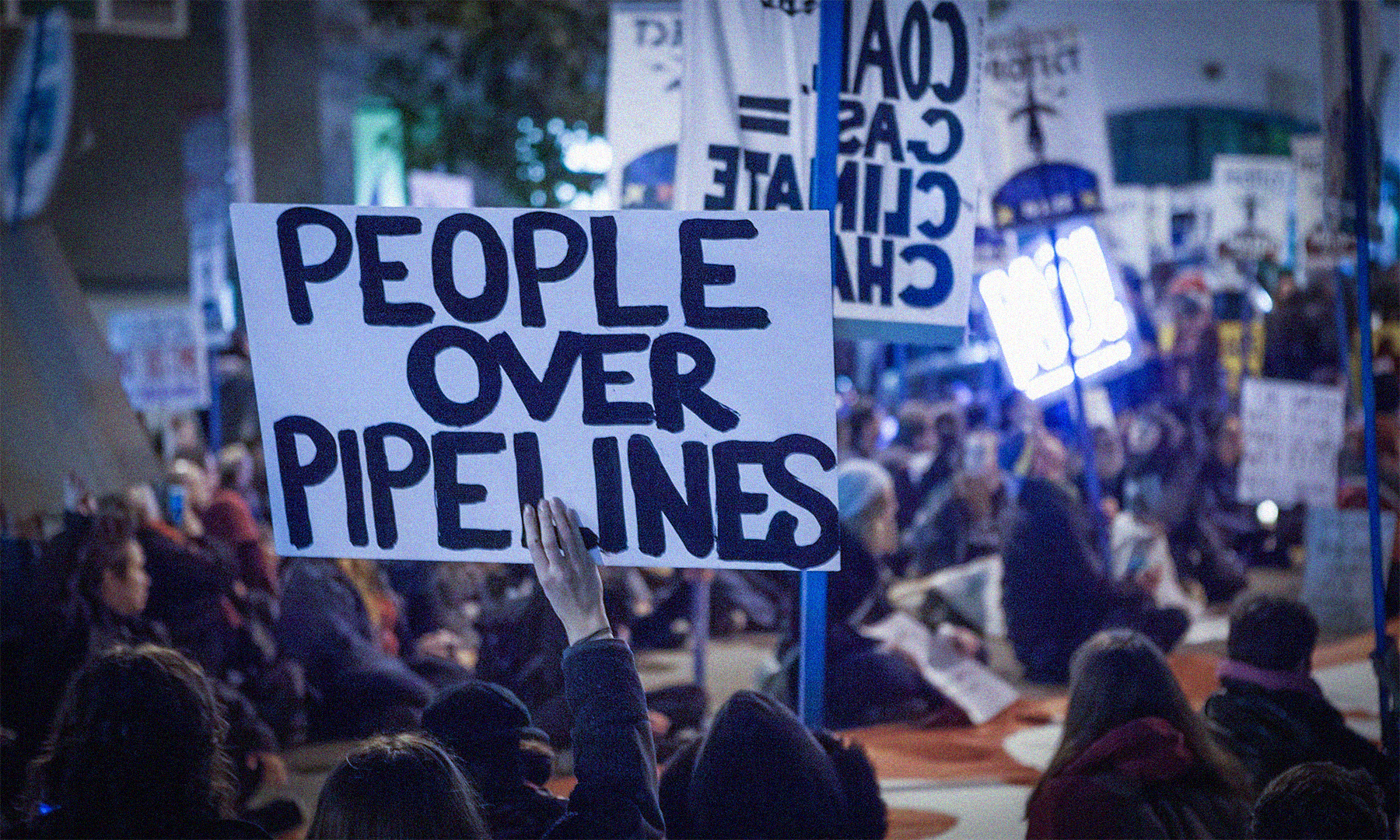

More than any other energy project, Keystone XL supercharged popular opposition to new fossil fuel infrastructure across North America. The pipeline expansion was first proposed during the George W. Bush presidency, and would have carried up to 830,000 barrels of carbon-intensive Alberta crude per day to Steele City, Nebraska. From there it would connect to the existing Keystone pipeline, which supplies refineries in Oklahoma and Texas.

The high risk of spills along the XL route—there have been three major spills in the past five years on the existing line, and thousands of small-to-significant incidents over the pipeline’s lifespan—was a key reason Indigenous, farmer and environmental groups took Trump’s re-approval of the project in 2017 to federal court. That and the clear contradiction between locking in tar sands exports and taking action on the climate emergency.

The Biden administration’s definitive cancellation of Keystone XL in January 2021 was a victory for democratic politics—messy as they can be—over climate denialism and government capture by fossil fuel interests.

The trade and investment treaty drag on climate policy

Keystone XL was officially killed off in June that year, but like “the infected” in HBO’s The Last of Us the pipeline has lunged up at the Biden administration from death to take a bite out of the public purse. In July 2021, TC Energy and its subsidiary, TransCanada Pipelines, launched a massive $15 billion USD investor-state dispute settlement (ISDS) against the U.S. under the expiring investment chapter of the North American Free Trade Agreement (NAFTA).

ISDS tribunals, a ubiquitous feature of post-NAFTA trade deals and investment treaties, are often likened to corporate courts by opponents, since the private arbitration they offer for settling disputes with governments is exclusively available to investors. Fossil fuel and mining companies are responsible for a significant share of ISDS cases, often demanding compensation for environmental and conservation measures.

— Read more about the use of ISDS by Canadian energy and mining firms here.

The idea that fossil fuel companies should have compensable rights to generate revenue—even from actions that are killing the planet—is ludicrous.

In TC Energy’s request for NAFTA arbitration—the second formal step in the ISDS process—the company says the Keystone XL cancellation was purely political and discriminatory, violating its treaty rights to national treatment and most-favoured-nation treatment, since other U.S. pipelines continue to operate or get approval. TC Energy also says it was denied fair and equitable treatment and that the cancellation’s effect on its profits was “tantamount to expropriation.”

The idea that fossil fuel companies should have compensable rights to generate revenue—even from actions that are killing the planet—is, on its face, ludicrous. But in the world of ISDS this is often taken for granted. It is no wonder climate justice activists want to dismantle the ISDS regime locked in by treaties like NAFTA as a real and present threat to climate action internationally.

Europeans were shocked last year when British firm Rockhopper was awarded in excess of €250 million ($360 million CAD) for Italy’s ban on offshore oil and gas drilling. The company had invested no more than €29 million and had not secured a permit to drill, but the private tribunal felt Rockhopper was owed the potential value of its unusable offshore claim.

This baffling decision by the tribunal was a last straw for many EU member states, a half-dozen of which shortly after decided to exit the Energy Charter Treaty that Rockhopper used to sue Italy. TC Energy could prevail in the same way in its NAFTA case if the tribunal can get to a decision on the merits of the company’s arguments. But that scenario is precisely what has been put into question by a U.S. proposal tabled before the tribunal in January.

Neutering TC Energy’s NAFTA case

Though Canada and the U.S. removed ISDS from the renegotiated Canada–U.S.–Mexico Agreement (CUSMA), NAFTA’s investment protections were extended to “legacy” investments (i.e., investments made by U.S. companies in Canada and vice versa prior to July 2020) for three years ending July 2023. TC Energy believes its investment in the Keystone XL expansion fits the bill.

—Read more about the “legacy” cases to date against Mexico, Canada, and the U.S. in the new CCPA co-production, NAFTA’s Shadow of Obstruction.

Normally, ISDS cases take years to decide, and this closely watched challenge to climate action is just getting started. But, in an interesting twist, the U.S. has proposed to bifurcate (i.e., split in half) the case to first consider whether TC Energy has a right to bring this case forward to begin with. According to U.S. lawyers, though CUSMA extended ISDS for three years into the new agreement, it cannot be used to challenge government actions taken after July 2020, when NAFTA ceased to exist.

This is not how most trade lawyers understand the situation. For the past year, law firms that provide counsel in ISDS cases have been encouraging companies to file notices of intent to launch NAFTA “legacy” claims before an April 30 deadline for doing so. Mexico is currently facing a half-dozen or so “legacy” claims while Canada has faced just one ( Koch Industries’ expropriation case involving Ontario’s decision to cancel cap-and-trade).

It’s likely we will hear of many more cases before this spring is over. That is, unless the U.S. view of the situation could be confirmed by Canada and perhaps Mexico too.

Canada’s time to act is now

TC Energy has lashed out at the U.S. interpretation of the CUSMA “legacy” clause in this case, saying the Biden administration is trying to “game the system” with a “post hoc rationalization” that isn’t consistent with the ordinary meaning of the CUSMA text. If what the U.S. says is true, the company asks, why is there no corroborating public record from Canada and Mexico?

Canada should provide that evidence now, by intervening in the TC Energy case early in support of the U.S. position. This could end an expensive and nefarious dispute years ahead of schedule—saving the U.S. government millions of dollars in legal fees and arbitration costs and sending a message that governments will not let Big Oil threaten and punish countries transitioning away from fossil fuels.

The quickest and easiest course of action would be for Canada to send a letter to the tribunal agreeing with the U.S. position. Currently the tribunal has only the U.S. request and TC Energy’s objections on which to base its decision, due in mid-April. Though the tribunal would not be bound by Canada’s interpretation of the “legacy” clause in CUSMA, Canadian support for the U.S. position would provide some corroborating evidence that TC Energy’s claim should be thrown out.

If Canada and Mexico both came out now to clarify that “legacy” ISDS cases can only be lodged against government actions taken before July 2020, the U.S. position might be further strengthened. Were the tribunal to agree, it could save all three countries potentially hundreds of millions of dollars in legal and arbitration fees from new “legacy” claims lodged before the end of April.

It must be stressed that there is no guarantee the tribunal would agree with Canada or Mexico should they decide to intervene to back the U.S. at this stage in the arbitration. Even official interpretative statements issued by the NAFTA Free Trade Commission, which were meant to be binding on ISDS panels, have been ignored by arbitrators with their own views of what trade negotiators intended when drafting the treaty.

Canada should speak up anyway. Governments have a right and duty to take responsible measures to rapidly lower greenhouse gas emissions. If there is even a small chance to support that public right—in our backyard—against the untenable investor rights of energy firms to profit from fossil fuel infrastructure, we have a responsibility to take it.