TC Energy has reached the end of the line in its legal vendetta against the Biden administration for terminating the Keystone XL pipeline in January 2021. A NAFTA investor-state dispute settlement (ISDS) tribunal has sided with the U.S. on a key jurisdictional issue, putting a stop to the Canadian fossil fuel company’s outrageous $15-billion lawsuit.

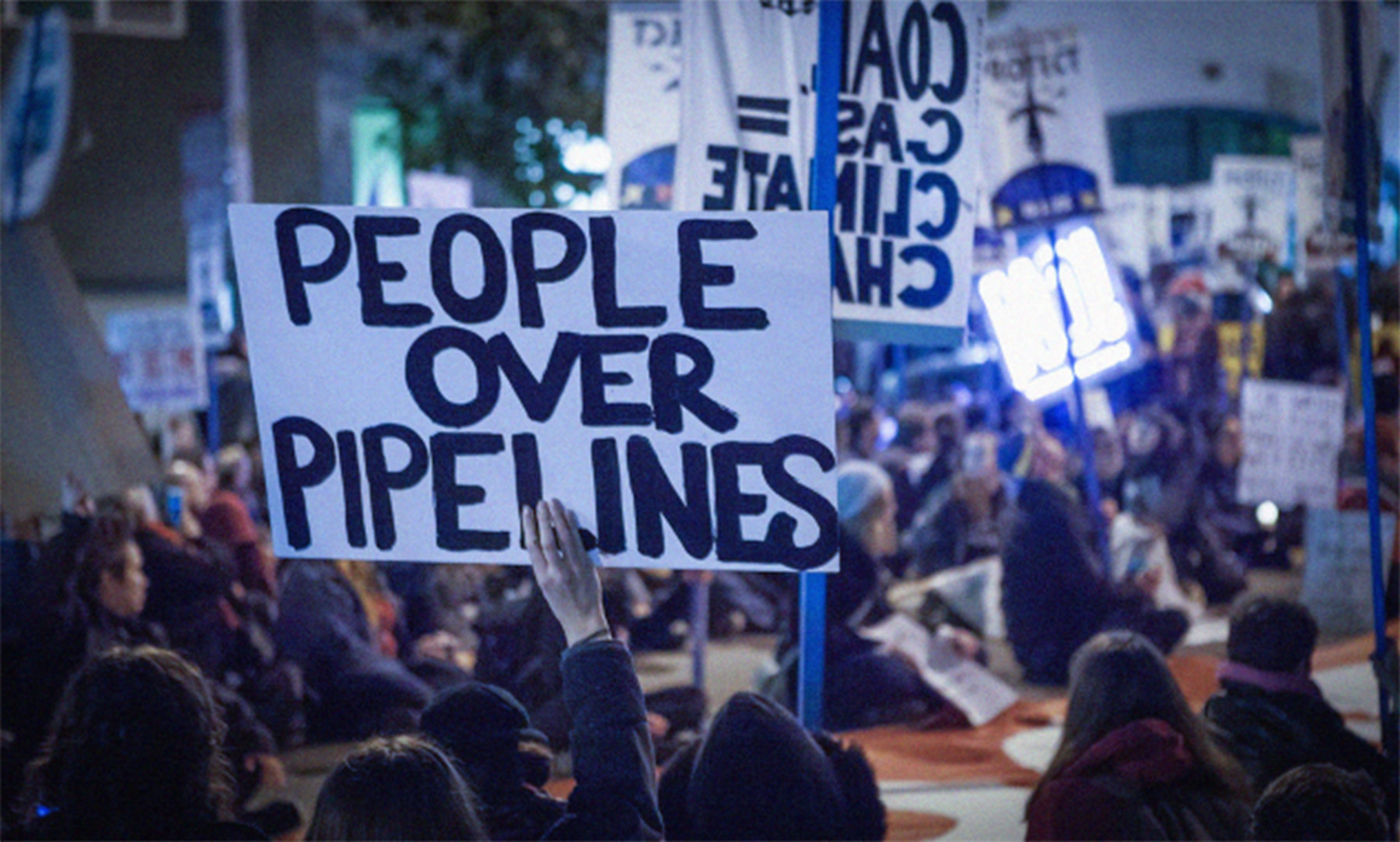

The somewhat surprising decision will be a huge relief for U.S. climate activists, farmers and Indigenous communities who fought successfully to stop the Keystone XL pipeline expansion from going ahead. Still, the threats that investment treaties and ISDS cases like this create for governments trying to address the climate emergency persist and must be dealt with. TC Energy lost on an obscure jurisdictional question, but comparable fossil fuel ISDS cases have resulted in huge penalties against governments—a key reason why the European Union just withdrew from the Energy Charter Treaty, the world’s largest ISDS treaty.

Furthermore, TC Energy’s NAFTA loss shines a light on Canada’s floundering defence in a similar multi-billion-dollar NAFTA “legacy” lawsuit over Ruby River Capital’s failed efforts to secure approval for a massive liquified natural gas (LNG) plant and pipeline (known as the Energie Saguenay project) at the estuary of the Saguenay River in Quebec. Canada could have, but didn’t, raise the same successful jurisdictional defence as the U.S. did in the TC Energy case. This now looks like a serious mistake with potentially huge costs to the Canadian public.

Short background on the TC Energy case

One of the new Biden administration’s first acts in office in early 2021 was to terminate TC Energy’s federal approval to construct the Keystone XL pipeline expansion. The project would have doubled the capacity to export highly polluting oil sands crude from an existing Keystone pipeline that runs from Hardisty, Alberta to refineries in the U.S.

The frequency of spills from Keystone 1 and the potential of a second line to increase greenhouse gas emissions convinced a wide cross-section of Americans that the expansion should not move ahead. Heeding these concerns, in 2015, the Obama administration denied TC Energy a permit for the XL expansion. A year later, the Canadian company launched its first $15 billion NAFTA lawsuit claiming the U.S. decision indirectly expropriated its profits and violated its right to fair treatment under the treaty.

Shortly after Donald Trump was elected president, in 2016, he reversed course and approved Keystone XL on condition that TC Energy drop its NAFTA suit, which it did. But multiple lawsuits in U.S. courts, including from Indigenous tribes, challenging flawed environmental assessments by the Bureau of Land Management, U.S. Fish and Wildlife Service, and U.S. Army Corps of Engineers, meant the project could not move forward.

In that sense, the Biden administration’s final termination of Keystone XL simply acknowledged a fait accompli. Shortly after, in June 2021, TC Energy announced it was abandoning the project completely. It then launched a second, very similar investor-state dispute against the U.S. under a “legacy annex” in the investment chapter of the Canada-United States-Mexico Agreement (CUSMA) that replaced the North American Free Trade Agreement (NAFTA) in July 2020.

What are “legacy” investor-state disputes?

When Canada, the U.S. and Mexico renegotiated NAFTA, they agreed to significantly alter the old treaty’s investment dispute process. While the substantive investment protections in the new CUSMA were familiar, Canadian investors in the U.S. and U.S. investors in Canada could no longer directly access international arbitration tribunals to challenge government decisions. U.S. investors in Mexico and vice versa could access a pared-down version of ISDS.

However, a so-called legacy annex tacked on to the CUSMA investment chapter was widely interpreted to allow any North American investor to rely on NAFTA’s old ISDS process for a further three years (to July 1, 2023). Dozens of investors took advantage of this “legacy” process to launch cases, including the one from TC Energy against the U.S., the multi-billion-dollar Ruby River case against Canada, and a dozen ISDS cases against Mexico.

Combined, these cases created potential liabilities for the three governments in the tens of billions of dollars.

The U.S. defence against TC Energy

TC Energy had hoped to convince the CUSMA investment tribunal that the U.S. decision to terminate Keystone XL violated its minimum standard of treatment and expropriated its future profits to the tune of $15 billion USD (about $20 billion CAD). Instead, the tribunal has tossed out the case on jurisdictional grounds.

This is a clear victory for climate policy against undue corporate challenges. But it is a limited victory, based on a jurisdictional issue unique to CUSMA, that only underlines the broader threat of such ISDS cases for climate policies internationally.

We won’t know the details of the tribunal’s decision for some weeks. From news accounts, which include reaction from TC Energy, it seems the tribunal agreed with the U.S. view on the temporal limitations of the three-year “legacy” annex. On July 12, a majority decision terminating the ISDS case was handed down by the three-person tribunal, along with a dissenting opinion by the company-appointed arbitrator.

Contrary to expectations, the U.S. appears to have successfully argued that the CUSMA tribunal lacked jurisdiction to hear the TC Energy case because the “legacy” annex only applied to government actions that occurred before July 2020, when NAFTA was still in force. (You can read more about the U.S. case in the June 2023 CCPA briefing note, Canada’s Options for Intervening in the Keystone XL CUSMA Lawsuit.)

Canada drops the ball in Ruby River “legacy” case

The positive result in the TC Energy case raises serious questions about Canada’s fumbling defence in a similar CUSMA “legacy” lawsuit from Ruby River Capital, which is suing Canada for billions over the federal and Quebec governments’ decisions, mainly on environmental grounds, to deny approval to the Energie Saguenay project.

Canada regularly intervenes in NAFTA investor-state disputes against the U.S. and Mexico where it feels it needs to clarify how the treaty’s investment rules should be interpreted by the tribunal. Yet while Mexico jumped into the TC Energy dispute to back up the U.S. interpretation of the legacy annex, Canada said nothing.

Had Canada joined Mexico in confirming the U.S. interpretation of the CUSMA legacy annex it would have been even more difficult for the TC Energy tribunal to contradict it. The fact that a majority of the tribunal seems to have accepted the validity of the U.S. interpretation of the legacy annex makes Canada’s inaction look even more baffling and irresponsible.

Canada also did not raise a U.S.-style defence on the temporal limits of the “legacy” provisions in the expensive, highly controversial LNG case brought by Ruby River last year. Instead, Canada’s legal team made half-hearted attempts to stay the proceedings pending the TC Energy tribunal’s decision, and an equally weak request to split the proceedings to consider less important jurisdictional objections. The tribunal refused both requests.

The most plausible explanation for Canada’s absence from the TC Energy dispute and poor showing so far in Ruby River is that the government did not want to be seen to undermine TC Energy’s case and a parallel CUSMA “legacy” case from the Alberta Petroleum Marketing Commission (APMC) against the Keystone XL termination. Had Canada backed the U.S. view on the temporal limits of the legacy annex, it would surely have antagonized TC Energy and the Alberta government.

But what should Canada do now?

ISDS tribunals are not bound by the outcomes of other cases, as the Ruby River tribunal has made clear in recently published documents. But given the similarity of the U.S. jurisdictional defence in TC Energy and APMC “legacy” cases—and the statistically curious fact that the U.S. has never lost a NAFTA investor-state dispute—it’s quite likely the Alberta Crown corporation’s irresponsible NAFTA lawsuit is, thankfully, also now doomed.

Canada, on the other hand, may have compromised its defence in the ongoing Ruby River dispute, which will consider the jurisdictional issues and the merits of the company’s case at the same time. Canada can still point to the TC Energy win for the U.S., but the tribunal may question why Canadian lawyers didn’t raise the temporal issues earlier. Clearly frustrated by the Canadian government’s inaction, the Quebec government has already requested intervenor status in order to raise this key jurisdictional issue before the tribunal.

Thanks to the welcome dismissal of the TC Energy lawsuit, the federal government’s legal team still has a chance to redeem itself by vigorously supporting Quebec’s arguments that the Ruby River case should be dismissed on similar grounds. Like the Biden administration’s Keystone XL decision, the pivotal decisions to reject the Energie Saguenay LNG project were taken after the termination of NAFTA on July 1, 2020.

An even more laudable approach by Canada would be to join with the U.S. and Mexico to issue a binding interpretation of the legacy annex that would disallow all claims relating to government actions taken after NAFTA’s replacement by CUSMA. The CCPA and 33 other Canadian, Mexican and U.S. civil society groups proposed the idea to North American trade officials in May but with no response to date.

Such a step would bury, once and for all, NAFTA’s noxious ISDS mechanism and eliminate billions of dollars in potential liabilities for North American governments and citizens. We should then collectively—in North America or internationally—consider “a broader initiative aimed at removing Investor-State Dispute Settlement (ISDS) liability entirely from all existing trade and investment agreements involving our governments,” as the civil society letter also urges.