Gasoline prices in Ontario are skyrocketing. As of March 7, the price for regular unleaded was just shy of $1.85 in the Greater Toronto Area and even higher in northern Ontario. And prices are not finished climbing.

Premier Doug Ford blames the federal carbon tax. “We see the gas prices going through the roof because of the carbon tax,” he said recently.

It’s a theme the premier has returned to time and again, but the carbon tax isn’t what’s driving gas prices through the roof. The price of crude oil is.

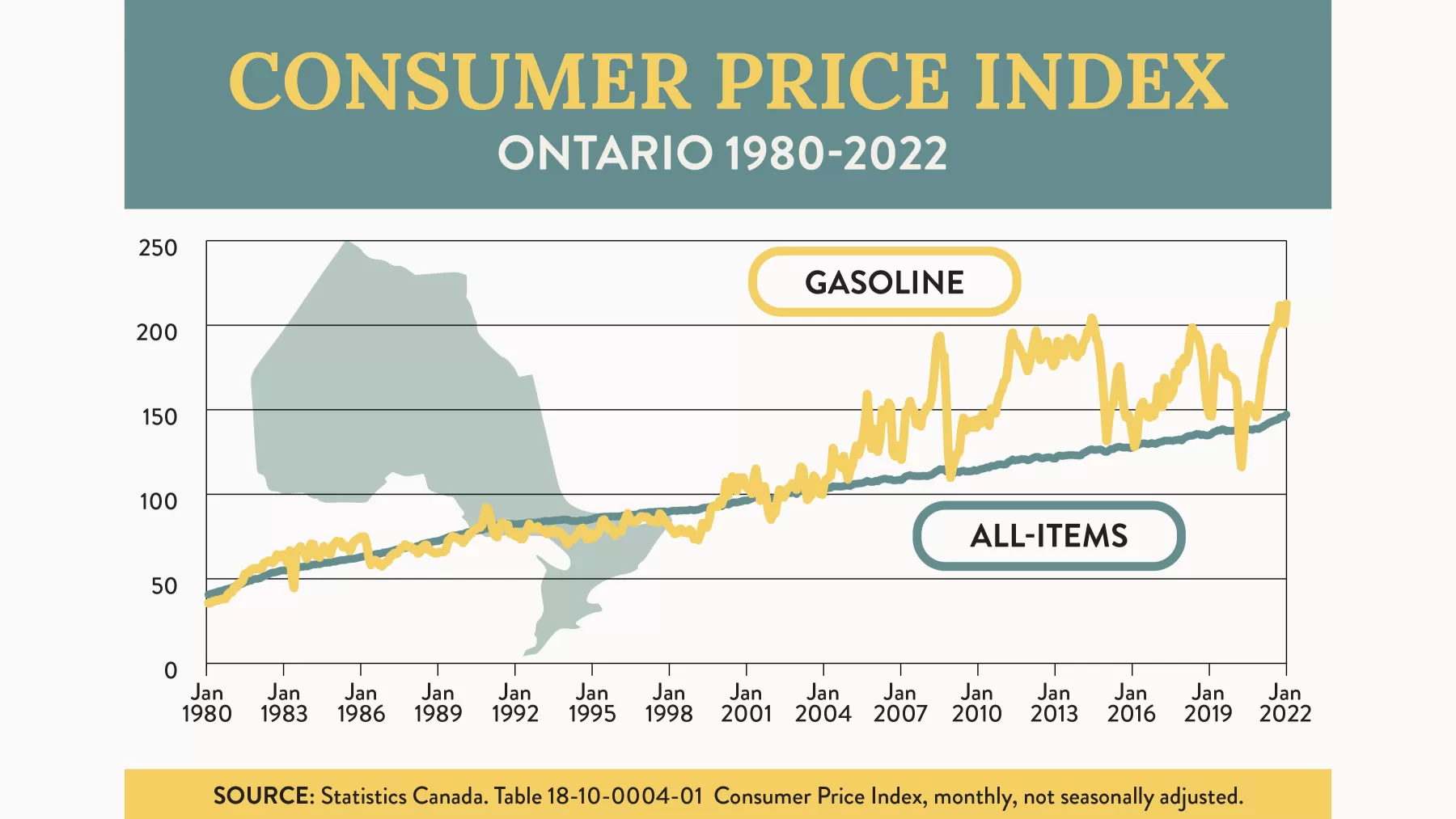

Nothing Ontarians buy is subject to wilder price swings than gasoline. In the last 30 years, the all-items Consumer Price Index (CPI) has risen slowly and steadily, staying in the range of two percent a year for most of that time. Gasoline prices, in contrast, went up by 32% in 2021 alone. Those prices often fall just as quickly as they rise, but over the long term, the trend is relentlessly upward, and this was true long before the carbon tax came along. Compared to 2002, the current base year for calculating the CPI, inflation is 47% higher for all items but 113% higher for gasoline.

Gas prices in Ontario are made up of several components. Payments for crude oil, the wholesale margin, and the retail margin go to

the oil and gas industry; the federal excise tax, the Ontario gas tax, the federal carbon tax, and the HST go to the government.

Since 1987, the province has published data on how much of the pump price goes to each component. Using wholesale and retail costs from January, which added 32.6 cents/liter to gas costs then, we can estimate how much of the increase in gasoline prices is caused by higher crude costs as of today, March 7.

|

Factors causing gasoline prices to rise since March 2019 (Greater Toronto Area) | ||||

|

Prices on 03/01/2019 (cents/litre) |

Prices on 03/04/2022 (cents/litre) |

Change (cents/litre) |

% of change caused by each factor | |

|

Pump Price Per Litre |

114.9 |

184.9 |

70.0 |

100.0% |

|

Crude Cost |

47.0 |

97.5 |

50.5 |

72.2% |

|

Wholesale Margin |

19.7 |

26.0 |

6.3 |

9.0% |

|

Retail Margin |

10.3 |

6.6 |

-3.7 |

-5.3% |

|

Federal Excise Tax |

10.0 |

10.0 |

0.0 |

0.0% |

|

Federal Carbon Tax |

0.0 |

8.8 |

8.8 |

12.6% |

|

Ontario Tax |

14.7 |

14.7 |

0.0 |

0.0% |

|

GST/HST |

13.2 |

31.3 |

8.1 |

11.5% |

Sources: Government of Ontario, “Gasoline report – pump price revenue shares,” gaswizard.ca, and author’s calculations. Wholesale Margin and Retail Margin are most recent data from Jan. 1, 2022. Crude price today is calculated by subtracting all other costs from pump price.

As the table shows, 72% of the increase in gas prices since March 2019 has been caused by soaring prices for crude oil, while 13% of the increase has been caused by the carbon tax. Rising wholesale costs added 9%, while the GST added 11.5%. Both the federal excise tax and Ontario tax are fixed per-litre costs, so they did not change. The only factor putting downward pressure on prices was at the retail level, where price competition is most likely.

To be clear, the cost of the carbon tax at the pumps, while modest, does not reflect the actual cost to the consumer. The federal government estimates that 8 out of 10 families will get back more money from the Climate Action Incentive rebate than they pay at the gas pumps. As of today, the carbon tax represents less than 5% of the cost per liter of gasoline.

The whole point of the carbon tax is to encourage people to use fewer fossil fuels to help slow climate change while giving them time to adapt. Geopolitical events and predatory oil companies aren’t nearly so gentle. From the “oil shocks” of the 1970s to Vladimir Putin’s invasion of Ukraine, dramatic hikes in gas prices are part of our past, our present, and our future. The gas prices we were told would arrive in 2030 are here in 2022. These high prices won’t go away soon, but if and when they do, history tells us that they will not wait long to come roaring back.

The solution to high gasoline prices is not to cut taxes that are currently being rebated back to consumers or help to pay for roads. The answer is to reduce our reliance on fossil fuels altogether, and the best time to do that is now before prices rise any further.

Ontario gasoline prices are still at levels Europeans would consider ordinary. In June 2020, when gasoline cost $1/litre in Toronto, it was $1.80/litre in the U.K., $1.90/litre in Germany, and $2.00/litre in France. This week in Britain, average prices hit $2.55/litre in Canadian dollars.

North Americans have been slow to recognize the urgency of the climate crisis. A 2019 study by the International Energy Agency showed that personal vehicles in Canada have the biggest engines, the worst fuel efficiency, and the highest greenhouse gas emissions per kilometer of any country.

It’s nothing to be proud of. Any policy whose main objective is to make gasoline cheaper can only be at odds with our efforts to combat the climate crisis.

This article, originally published on March 4, was updated on March 7 to reflect newer gasoline prices.