March Labour Force Survey Key Facts:

- 1 million lost jobs, but another 2.1 million had a majority of their hours cut.

- 3.1 million Canadians lost work or a majority of their hours.

- 1 in 5 women (1.8 million) lost jobs or a majority of their hours.

- 1 in 4 youth (aged 15 to 24) lost jobs or a majority of their hours.

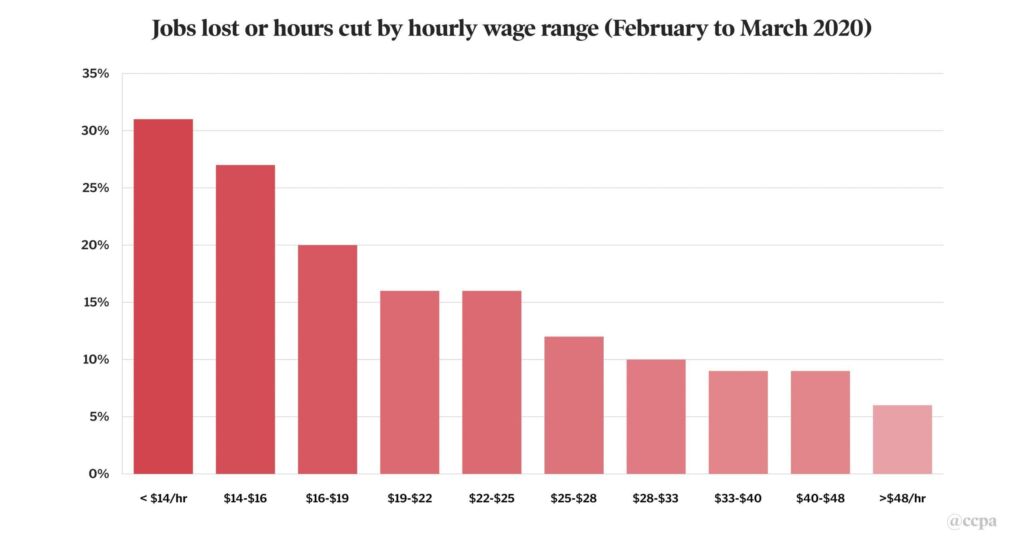

- 1 in 3 low wage workers making $14/hr or less lost jobs or a majority of their hours.

COVID-19’s impact on the labour market in Canada has been truly shocking. I estimated that impact two weeks ago, and even my worst case scenario seems hopelessly optimistic now once you include those who’s hours have been cut in half or more. Without the unprecedented closure of entire sectors of the economy, the health crisis would be much worse, but millions of Canadians have lost income in our collective effort to flatten the curve.

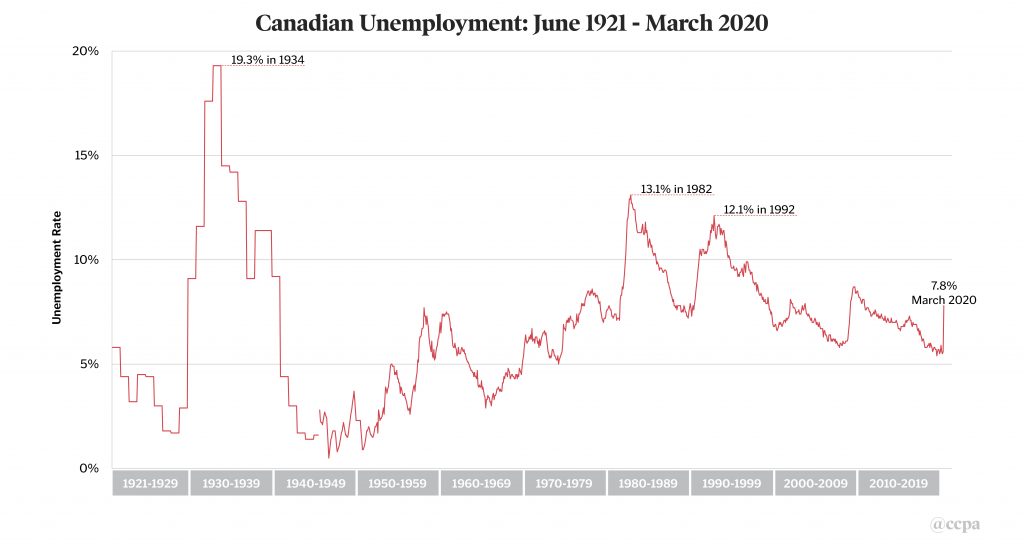

The official unemployment rate for March is 7.8%. This is certainly not yet at historic levels, but the number of people who’ve lost hours is a harbinger of things to come as the unemployment calculations catch up to what’s actually happening to Canadian workers.

Source: Statistics Canada table 14-10-0287-01, Cansim vector v2062815 & historical series D124-133

The unemployment rate doesn’t tell us anywhere near the full story. If you lost your job due to COVID-19, and stopped looking for work because you (reasonably) predicted you wouldn’t find any in the worst labour market since the Depression, you may be out of work but you’re not considered to be unemployed. You’re outside the labour force and don’t even factor into this high unemployment rate.

Today’s data is based on the week of March 15 to March 21. Plenty of workers were on vacation for March break and wouldn’t know they had been laid off until they tried to return to work the following week. Plenty more workers have been laid off since then, too. It’s only when the April survey data comes out in early May that we’ll know the full extent of this first round of layoffs.

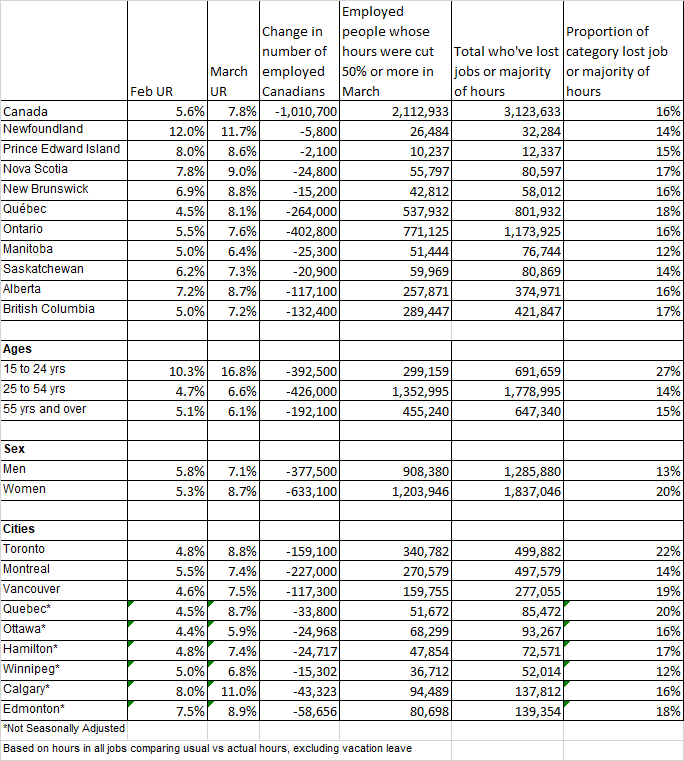

In this unprecedented situation, where workers are staying home due to public health directives, the most telling statistics are the drops in employment between February and March. And it’s not just people who have lost all employment, but those who have seen significant cuts in their hours who should also concern us. The table below breaks down these key measures across provinces, cities, age groups and sexes.

All told, more than 1 million Canadians who had a job in February no longer did in March. This includes both the officially unemployed and those who are not looking for work because of job scarcity. Another 2.1 million Canadian remain employed but have seen at least half of their hours cut. In total 3.1 million Canadian workers—16% of all workers—have been laid off or seen big reductions in their hours.

It's worth examining how many workers in an entire area or group lost their jobs entirely or saw their hours severely cut. The biggest impacts are in Ontario, where 1.2 million people lost hours or jobs; half a million of those job losses are in Toronto. In Quebec, an incredible 18% of all those employed in February had been laid off or saw significant reductions in their hours by March. Across Canada, youth aged 15 to 24 got absolutely pummelled: 27% of them were either laid off or experienced severe cuts to their hours.

Source: February and March 2020 Labour Force Survey PUMF, excludes self employed

Examining these job losses by hourly wage rates is perhaps the most sobering. A shocking 31% of all workers making $14 an hour or less were laid off or had their hours halved in March; 27% of workers making $14 to $16 an hour no longer have a job or had their hours of work cut. Many of these low-wage workers have little or no savings to fall back on in the best of times.

The Canadian Emergency Response Benefit (CERB) provides critical support to workers whose employment has been sacrificed in the battle to contain COVID-19. CERB is far better than the antiquated employment insurance system it replaces, but there are still far too many unemployed workers who fall through the cracks.

Of the workers who lost their jobs before the 15th of March, 604,000 didn’t meet EI’s byzantine requirements and also can’t get the emergency benefit. Another 175,000 workers were unemployed due to the virus but can’t qualify for the CERB because they didn’t earn $5,000 in the previous year. There are 390,000 unemployed Canadians who receive EI but still haven’t been topped up to the $500/week emergency benefit level.

There are another 2.1 million Canadians who have lost at least half their hours but aren’t fully unemployed. The emergency benefit doesn’t presently cover them, although it may be expanded to those with fewer than 10 hours of scheduled work per week.

The sheer scale of what is happening to Canadian workers goes far beyond these numbers. Thousands of people have lost their jobs, or lost a significant number of hours of work and are going to continue to struggle in the weeks and months to come. They’ve made this sacrifice for all of us so that we can stop this virus. We owe them a huge debt—and the income supports to go along with it.

For media interviews please contact Alyssa O'Dell, CCPA media and public relations officer, at media@policyalternatives.ca or 343-998-7575.