It's always nice to be recognized. So it was a pleasant surprise to see both Minister Don McMorris and the Saskatchewan Party address our latest study on the government's liquor privatization plan. Unfortunately, both the Minister and the Saskatchewan Party appear to be struggling with some of the math involved in our report. That's not surprising, particularly given the government has released no figures of its own to justify it's constant claim that its liquor privatization scheme will be revenue neutral. The Future of Liquor Retailing in Saskatchewan, the government's meagre ten-page "blueprint" for what is to be one of the largest privatization's in the province's history - devotes a mere 200 words to the question of government revenue (and no numbers). Fortunately, Minister McMorris has recently provided a little more in the way of numbers, noting:

"The new markup rate will replace any of the existing discount structures that currently exist for private retailers. While this new rate will be 25 per cent less than the overall markup rate, it will be neutralized by the cost the government currently bears to operate the 40 stores scheduled for conversion and related head office costs and discounts. This change will be revenue-neutral for the province’s finances."

It would be useful to see the numbers to justify the government's claim that the new diminished mark-up rate will be "neutralized" by the elimination of operating costs in the 40 stores scheduled for privatization. For our part, we actually did run the numbers, comparing the purported savings from privatization versus the purported costs. As author David Campanella explains:

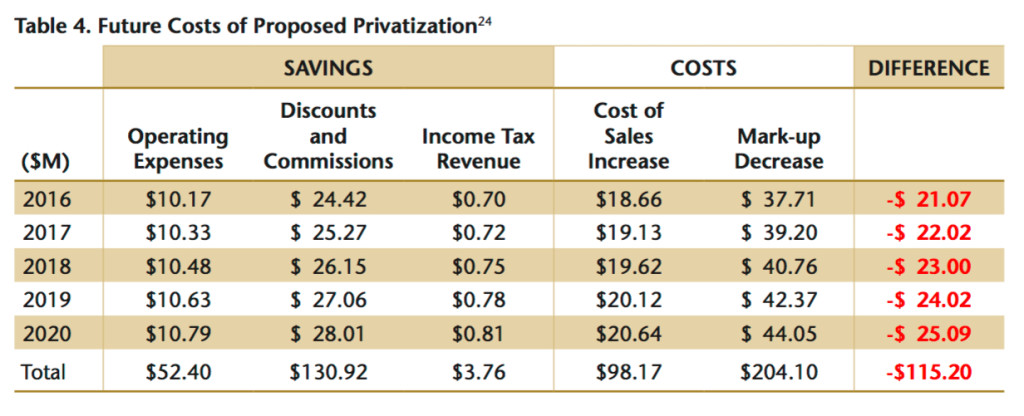

"The SLGA’s savings are fairly straightforward. By closing 40 publicly- owned retail stores, the SLGA will no longer have to pay the annual operating costs of these stores. The SLGA will also save money by no longer giving a discounted mark-up rate or commission to private retailers, who will instead be compensated with the 25% mark-up reduction. Finally, the Saskatchewan government will receive a very modest revenue bump of less than a million dollars per year from the corporate income tax paid by the new owners of the private liquor outlets. The new costs the SLGA would incur under the proposed changes are similarly straightforward, and they come in two parts. One new cost is that the government’s plan includes lowering the province’s liquor mark-ups by 25%... The second cost that would result from the proposal is higher overall wholesale costs. The government’s proposal to dramatically increase the share of retail stores that are privately-owned closely resembles BC’s approach to privatization in the 2000’s. From 2002 (the year before the BC government lifted its ban on new private liquor stores) to 2013 (the latest year for which Statistics Canada has data), the wholesale cost of liquor in BC increased on average by 6.0% per year. Therefore, the expected impact of increased wholesale costs is found by multiplying the SLGA’s wholesale costs by 6.0% for each year."

As you can see in the table below, if the report's calculations are correct, the costs of privatization outweigh the savings to the tune of over $20 million per year. Further note that even the if the estimates about the potential for rising wholesale costs of 6% prove to be lower - and given the BC experience that would be highly unlikely - the government's plan would still lose money (also note that corporate income tax revenue was calculated using the generous assumption that all stores would pay the full 12%, not the small business rate of only 2% which is much more likely for the majority of the proposed privatized stores).

Simon Enoch is Director of CCPA-Saskatchewan. Follow Simon on Twitter at @Simon_Enoch.